Credit unions have long argued that the future of the movement is with the Millennial and Gen-Z generations. These groups are more idealistic than their older counterparts, making them a great fit for mission-driven banking, less trusting of traditional banking (and particularly credit), and are seeking community. It sounds like all the things a credit union can offer, so how do why do credit unions struggle to reach these demographics? Through our conversations with dozens of credit unions, everywhere from $100m in assets to even $15bn in assets, there are a few simple reasons:

- Confusing/misaligned requirements for becoming a member

- The use of traditional marketing channels over new, digital channels

- Lacking a product “hook” that resonates with young consumers

Misalignment in membership requirements

Most credit unions are trying to make it easier to open an account digitally, which is a great and necessary first step to acquiring young members, but there are a few key factors that make it tougher for young people to get approved for membership:

These factors make it not only harder to qualify for loans, but often even basic checking accounts.

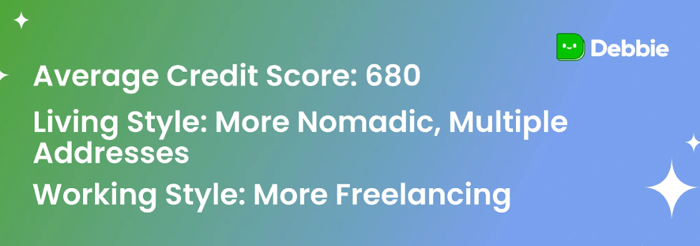

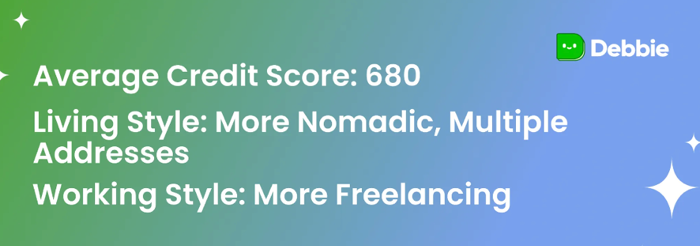

- Average credit: Many credit unions will say they want younger members but may not want to disturb their average member credit score. Many credit unions have an average member credit score of 720, and are wary to dip into the high 600s, although that’s where the majority of Millennials and Gen-Z are currently holding.

- Living style: Young people also often have multiple addresses, between their home address, their college address, and their first address as a working adult. These can oftentimes be in 3 different states, making identity verification more challenging. Many credit unions require manual approval/additional fraud checks when the ID address doesn’t match the mailing address—however, this is almost always the case for college students.

- Working style: Income is also tougher to prove, as more young people shift to freelance/gig work. Tracking the income is also often an issue for freelancers.

Adjusting to this new reality will mean opening up the approval criteria from a credit perspective and getting smarter about how to detect and prevent fraud. This will require credit unions to have more robust fraud protections—however, our belief is that fraud has more solutions than irrelevance and decreased market share.

CUs using traditional marketing channels

In every interview we have with credit union marketing leaders, we hear the same thing: many are using radio, billboards, and direct mail; some are using digital advertising such as Google search and Facebook ads, a good chunk rely on community partnerships such as schools, non-profits, and sports, while very few are using affiliate marketing or referral bonuses. Only one credit union we met (Consumers Credit Union in IL) was using affiliate marketing at scale.

However, 40% of companies in the U.S. attribute affiliate marketing as their #1 acquisition channel (including banks and Fintechs). Affiliate marketing is the practice of sourcing referrals and leads through affiliate or partner brands—for credit unions, that can look like blogs or websites (such as NerdWallet), influencers on Facebook, TikTok, or YouTube, and financial apps. These affiliates act as trusted third-parties who can represent your brand in a positive light, without being too sales-y. Most young people find their financial institutions through their friends, family, or affiliate networks.

Sourcing consumers through trusted affiliate channels means you have a better understanding of who they are, what their goals are, and how they found you.

Products require a “hook” to resonate

Having attractive rates on deposit accounts is a good place to start in terms of a “hook”. However, even large players like SoFi and Axos Bank have to amplify their message through various marketing channels. “Build it and they will come” is not a mantra that is going to move the needle in this competitive market when consumers have lots of options.

Back in the 1930s, banks used to offer toasters as a way of getting new customers through the door—and it worked! In this day and age, consumers are seeking financial institutions that will reward them for their loyalty. This is why credit card programs are some of the most successful financial products of today’s age. It’s time we took that model and reversed it for the benefit of young consumers and rewarded them for positive financial behavior (rather than just spending).

Visit our CSS website to learn how Debbie can help you drive membership growth and operational excellence at an attractive price.