Why do consumers choose and use reloadable debit cards?

Reloadable debit cards are an alternative for those consumers who don’t write checks.

by. Rob Rubin

Reloadable debit card accounts look very similar to standard checking accounts: They include features like online bill pay, mobile banking, direct deposit, and access to cash through ATM networks. They’re easier to open for some because customers’ information are not put through ChexSystems for approval. From a consumer’s perspectives, the biggest differences are that you can’t write checks unless they’re pre-authorized, and you can’t overdraw the account.

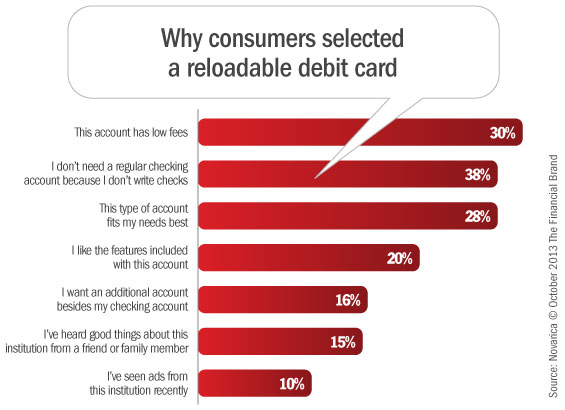

Over the last several months, shoppers visiting FindABetterBank have been able to compare checking accounts and reloadable debit cards. While most shoppers on the site are specifically looking for checking accounts, approximately 3% of shoppers choose reloadable debit cards. While that seems like a small percentage, only one of the reloadable debit cards listed is a national brand, and most consumers are not familiar with how reloadable debit cards work. Why did shoppers choose a reloadable debit card?

Base: FindABetterBank shoppers that selected a reloadable debit card and responded to the survey between August and September 2013.

Is this type of cash management account a viable alternative to checking accounts for many consumers, or is it a product for the unbanked, or for those who won’t be approved through ChexSystems? Analysis of the banking behavior of customers selecting these cards can shed some light:

- Reloadable debit cards appeal to unbanked shoppers. Twenty-five percent of shoppers selecting reloadable debit cards indicated that they don’t have a direct deposit compared to 20% of shoppers overall. These shoppers maintain much lower balances than those with direct deposits and are more likely to select one of these cards due to low fees — 40% versus 27%, respectively.