The first three quarters of 2020 were definitely ones for the history books. Heading into 2020, there seemed to be an optimistic feeling toward economic growth. Conversely, being an election year, there was also a sense of potential market turbulence as the election approached. However, no one could have foreseen what has unfolded as this year progressed. The words “unprecedented,” “pandemic,” “quarantine,” “new normal,” “mask-up,” and “social distancing” quickly became a part of almost everyone’s vernacular. Sporting events were canceled, entire industries were deemed “essential” or “non-essential,” historic stimulus plans were passed, central banks across the globe took extraordinary steps to inject liquidity into markets, and the populace began socializing with friends and family via zoom calls. All of this, among other things, has greatly impacted financial institutions.

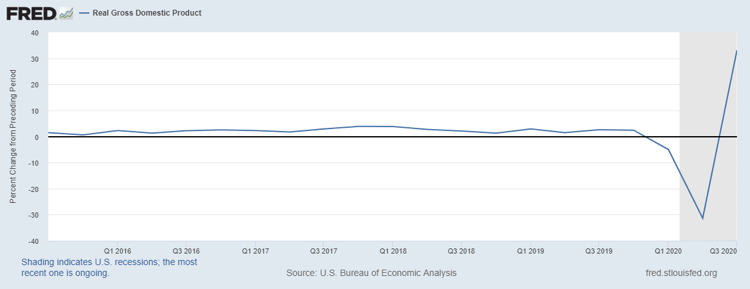

GDP was broadly impacted by the coronavirus as state governments across the country instituted various lockdowns in hopes of flattening the virus curve. The first quarter of 2020 saw economic growth fall ~5%, followed by a significant collapse of 31% in the second quarter. (See figure 1 below)

However, as lockdowns subsided toward the end of the summer, and the effects of the myriad of stimulus programs the federal government passed set in, economic growth grew a staggering 33% in the third quarter. The strength of the recovery, however, is still very much in doubt with Congress failing to agree on additional stimulus measures and cases begin to rise again around the world.

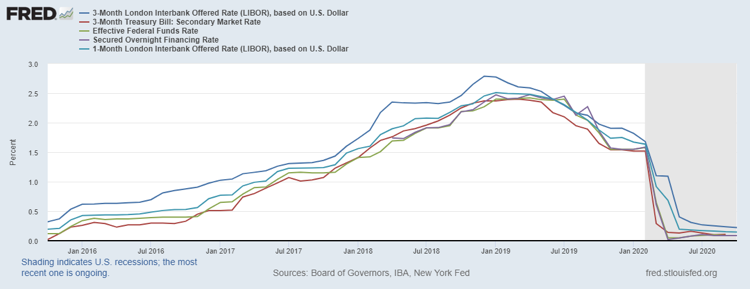

Heading into the year, there was a lot of discussion around the Fed’s monetary policy and general market interest rates with the ensuing LIBOR phase out. Any sort of longer-term Fed strategy was thrown out of the widow to infuse liquidity into the market aimed at combating the economic effects of COVID. To the Fed’s credit, they acted swiftly, dropping interest rates to near zero levels in a matter of weeks. Furthermore, they enacted a slew of liquidity programs to further backstop markets. (See figure 2 below)

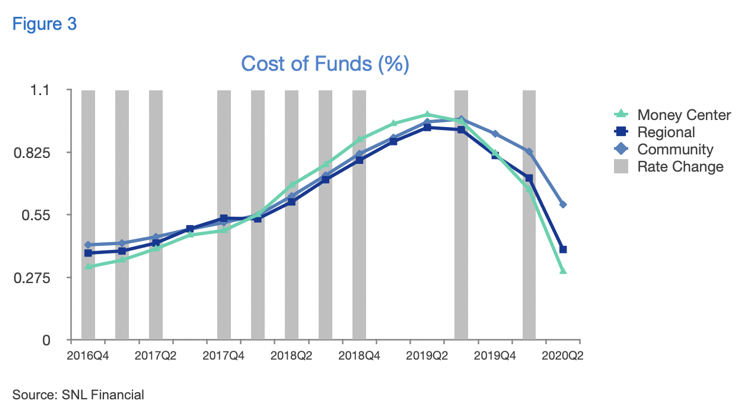

Consequently, financial institutions experienced extreme deposit liquidity resulting in a drop in funding costs. Notably, the largest financial institutions witnessed the greatest savings, while smaller, community financial institutions experienced slower savings. (See figure 3 below)

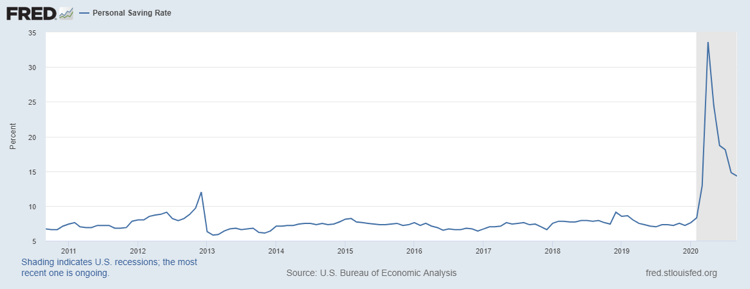

To further highlight the level of excess liquidity in the market, personal savings rates jumped to historical highs, peaking at 33%, and have started to drift down. (See figure 4 below)

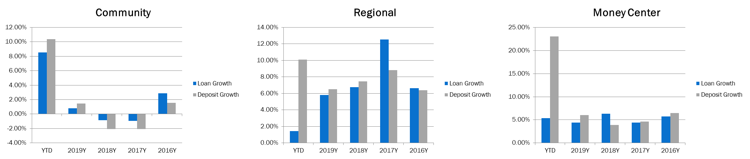

Heading into 2020, both regional and money center financial institutions experienced strong loan and deposit growth from 2019 with community financial institutions lagging behind. Looking at total loan and deposit growth through the first half of the year, it is not surprising to see such large deposit growth across all financial institution sizes. Notably, community financial institutions have experienced strong loan growth, which is overwhelming from loans provided via the government PPE program. (See figure 5 below)

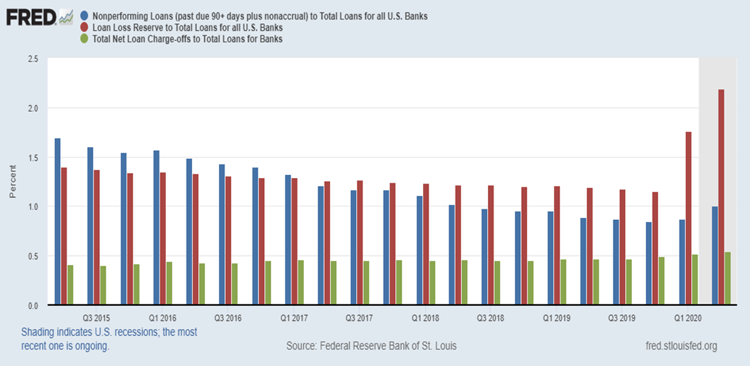

From a credit perspective, in anticipation of potential future loan losses, financial institutions increased loan loss reserves in the first quarter. In the second quarter, nonperforming loans ticked up, along with charge-offs, albeit to a lesser degree. The overall impact of COVID on loan portfolios is likely to be unrealized for many quarters to come. (See figure 6 below)

As has been the theme for much of 2020, we are still surrounded by uncertainty. Governments around the world have instituted unprecedented measures on all fronts of society to combat this global pandemic. However, much remains to be determined with time.