Amidst the towering heights of the Colorado Rockies, attendees at the CU FinHealth™24 Conference started their conference journey with a very clear wake up call.

“How have credit unions changed? Are we looking inward, or only outward, to address individuals’ financial challenges today?” asked keynote speaker Brenton Peck, Director of Financial Services Solutions for the Financial Health Network.

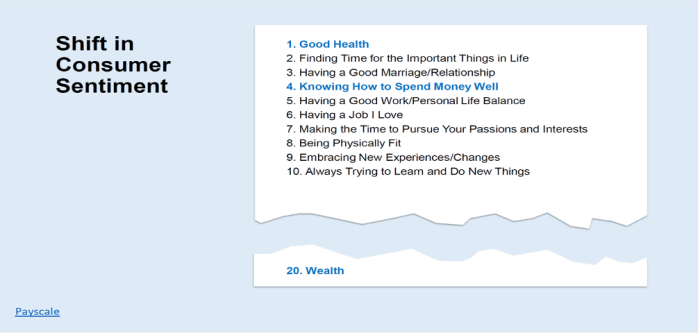

Peck laid out a compelling history of the 3, “once-in-a-lifetime” financial crises—9/11, the Great Recession of 2008-2012, and COVID—and cautioned the audience that we’ve created a “why bother” generation. He cited statistics showing the huge financial pressures inflation and stagnant wages have caused on multiple generations resulting in 73% of millennials and 49% of Boomers living paycheck to paycheck. He noted that consumer sentiment has shifted from wealth as a driver of happiness to good health, finding time for the important things in life, having a good marriage/relationship, and knowing how to spend money well.

He urged attendees to shift their thinking to credit unions being in the business of financial health. Such a focus drives loyalty, satisfaction, and cross-sell opportunities that help members truly thrive financially.

“People want a little cup of happiness,” concluded Peck. “Buy the damn latte!”

Now in its eighth consecutive year, the conference co-hosted with the Cornerstone Foundation, and the California and Nevada Credit Union Leagues, delved into the pivotal role credit unions can play in enhancing financial well-being for all. Key takeaways from the 2 ½ day conference include:

Commit, Assess/Learn, Plan, and Act: The Quick Start Guide created by Filene and the Foundation is the starting point to help your credit union be in the financial health business.

“It takes commitment from leadership, the board, and buy-in from the team to create sustainable change,” noted speakers Martin Carter, President/CEO, Astera Credit Union, and Creighton Blackwell, Chief Community & Public Affairs Officer, Coastal CU.

“You need to truly understand your employees’ and members’ financial health before you take action,” stated Wendy Krvanek, Marketing Mission and Business Development Manager, Credit Human, and Terri Hendrix, VP, Engagement, Carolina Foothills FCU.

“Planning what you’ll do with the data you have is key before taking action on financial health,” noted Jill Edsall, Director of Learning & Talent Development, Chartway FCU, and Jessica Sharon, VP of Impact and Advocacy, Pelican State CU.

“Investing in measuring members’ financial health—survey based, model based or a simple question at the end of a servicing transaction—can be a powerful way to drive focus and effort inside a credit union, noted Balaji Ponnuswamy, SVP, Financial Health Products & Programs, BECU, and Erin Coleman, AVP, Professional Services, Callahan & Associates. “Keep trying. This is not a sprint, but rather a marathon. There are no silver bullets that enable financial well-being for all, but rather a collection of actions that over time can have a meaningful impact.”

Look for the “invisible”: As part of the conference’s DEI Tuesday, speakers Samira Salem, VP, Diversity, Equity and Inclusion, America's Credit Unions, and Zack Christensen, Executive Director, CU Pride, urged attendees to use human-centered design thinking and empathy to serve populations who need credit unions. They gave three examples—women, gig workers, and kids aging out of foster care—and facilitated an exercise to help attendees think more broadly about the opportunities to meet people where they are and help them financially. Complementing Samira and Zack’s presentation was a panel of first-generation college students who shared their financial challenges and wish list for credit unions—“mentor us, show us how to manage our money, help us succeed.”

Leverage your vendors: 18 sponsors generously supported the conference. A round-robin session on Day 2 allowed attendees and vendors to collaborate on the most pressing issues practitioners face in implementing and scaling financial health within their institutions.

Use the FinHealth Hub: Through the generosity of donors to the FinHealth Fund, the Foundation has built the FinHealth Hub—a dynamic, interactive resource to learn, connect and share your financial well-being journey. From master class sessions to a discussion forum, the Hub is designed to support credit unions no matter where they are on their financial well-being journey.

Find your peeps: The conference closed out with sessions around actionable steps attendees could walk away with. Attendees had the opportunity to pick their speakers based on their very specific goals and walk through steps they could take when they get back to the office whether that was building a project plan, evaluating their data, understanding what makes a great financial coaching session, and thinking of alternative data to support lending to a broader segment of members.

You aren’t alone: Attendees at the conference were a unified community focused on improving employee and member financial health. Use the networking opportunities contained in the FinHealth Hub to connect with like-minded credit union professionals to help you on your journey.

For more inspiration and action, please visit the Foundation’s FinHealth Hub or reach out to Christine Hickey, the Foundation’s Financial Health Program Manager at chickey@ncuf.coop to discuss how your credit union can be in the business of financial health and well-being for all.