The auto market has seen drastic shifts since the beginning of the COVID-19 pandemic. The impacts are being seen in auto values and on car lots across the country.

There are several factors at play, all converging to shakeup the market. Here’s what’s causing the shift and what it means for credit unions.

Auto Values Have Hit Record Highs

Vehicle prices, both new and used, are at an all-time high. There are several factors—both pandemic and non-pandemic related—causing the spike.

Shrinking New Car Inventory Levels

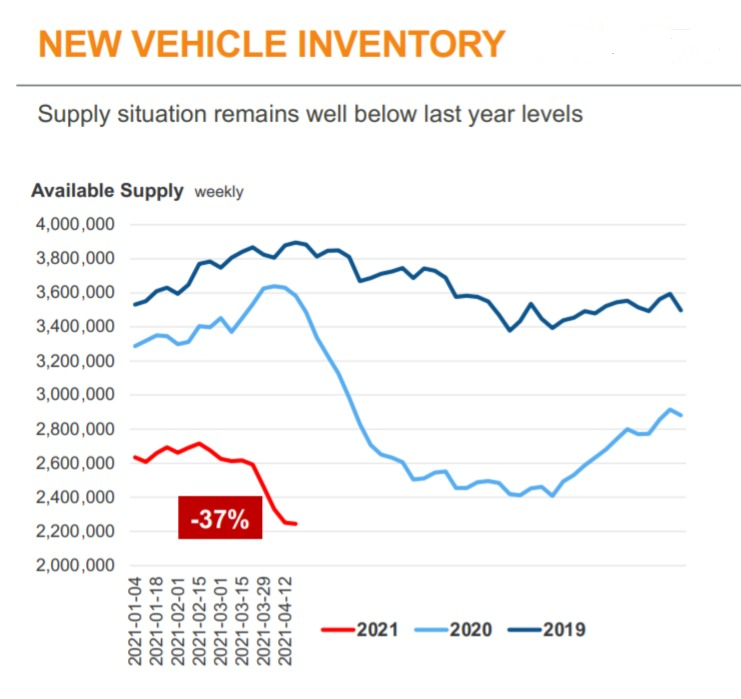

Auto manufacturers have been fighting supply chain and labor disruptions since at least the start of the pandemic. At the end of April 2021, new vehicle inventory was 37% lower than 2020 and 42% below 2019, according to Cox Auto.

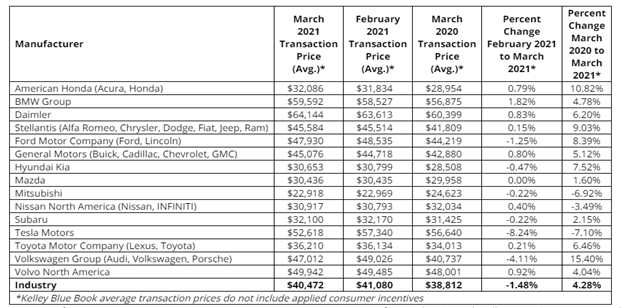

With fewer new vehicles being manufactured, prices have climbed. According to Kelley Blue Book, the average cost for a new car is up 4.3% year over year in March 2021.

Production has slowed and inventory is down thanks to two main interconnected considerations over the last 18 months:

- Factories shut down or reduced production due to pandemic restrictions

- Chip supply pipeline disruptions

In mid 2020, during the height of the pandemic as the world was adjusting protocols on the fly, many auto manufacturers had to stop or slow production to follow COVID-19 safety protocols like social distancing, quarantine restrictions, and PPE requirements.

As production ramped back up in early 2021, manufacturers found themselves in a supply crunch: a global shortage of microprocessor chips. So many products need microchips these days—picture the long virtual lines to buy a PS5 last Christmas—and without orders from auto manufacturers, chip producers sold off their supplies to other industries.

The auto industry, and the entire world, is experiencing a chip shortage—a part that’s vital to each and every vehicle produced. The shortage is so extensive that the U.S. Congress is discussing allocating funds to build American chip factories.

Fewer Used Vehicles

It’s basic economics: If demand stays the same (or increases) but supply decreases, prices go up. We’re riding the classic supply/demand curve. Used car inventory has shrunk for several reasons:

- Rental fleet disruptions

- Loan assistance leading to fewer repossessions

- Low inventory of new cars

Rental car companies make up a large portion of the used auto market by selling their 1-2 year old fleets to used auto dealers. When COVID-19 hit and rentals all-but dried up, rental car companies had to sell off their fleets and slash new vehicle orders. Because of lower demand last summer, rental car companies did not sell their older vehicles as normal and put a dent in the used vehicle supply.

Additionally, many people who were struggling financially through the pandemic, and may have been in situations that would have traditionally resulted in a car repossession, received assistance from lenders in the form of skip-a-pay or loan deferments..

Because of the new car inventory shortage, new car dealerships are buying up used cars to fill up their lots, putting more pressure on the used car supply.

The Result: Higher Used Vehicle Values

COVID-19, the chip supply shortage, rental fleet disruptions, loan assistance, and a shortage of supply in the used car market are all working together to lead to higher used vehicle values.

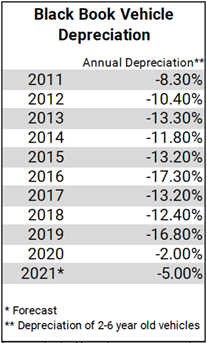

In 2020, depreciation hit an unprecedented low of 2%, according to Black Book, and is forecasted to be higher for 2021 but still well below depreciation values seen pre pandemic.

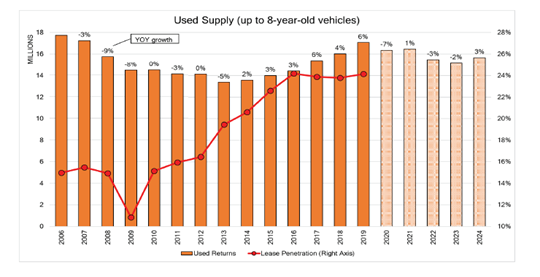

Used vehicle values are expected to continue to be higher than average, as used car supply is projected by Black Book to remain below 2019 amounts.

How Credit Unions Can Adapt

With the lower inventory in new cars, used car lending is expected to increase. Are you ready to capture a share of that market? Now is a prime time for credit unions to review their auto loan portfolios and take proactive steps.

First, take a look at your used auto portfolios. Compare your pricing, charge-off rates, delinquencies, and more with competitors—are your numbers in line? You can also look for additional lending potential—with higher asset values, there may be an opportunity to lend to members in lower FICO tiers.

Second, you can look at your indirect auto program. Do you have data on charge-off rates and/or delinquency history by dealer? If so, you can analyze that data and identify potential issues before they become a problem.

Third, you can use additional data points to make decisions about loan applications. Using debt-to-income (DTI) ratio and ability to repay can help in the loan decision-making process and potentially open opportunities to previously more-risky borrowers.

Last, you can stress your existing auto loan portfolio for a drop in auto values of 10% or even 15%. Auto values are expected to remain strong through 2021, but as supply balances out, depreciation will increase and values will steady. Stressing your portfolio will help understand what will happen if the pendulum swings the other way.

The Bottom Line

Even with the impact of COVID-19, the auto lending market continues to present opportunities for growth for credit unions. Higher used auto values combined with a lower interest rate environment may present an opportunity to refinance auto loans at lower loan-to-values, mitigating the potential increased credit risk presented by the pandemic.

Now is a good time for credit unions to evaluate existing loan collateral in your portfolio and to consider the cost-benefit relationship of making loans to borrowers with greater risk, based on the increased collateral value.

For help reviewing your portfolio data analytics and making decisions based on our new COVID-19 world, contact the 2020 Analytics team.