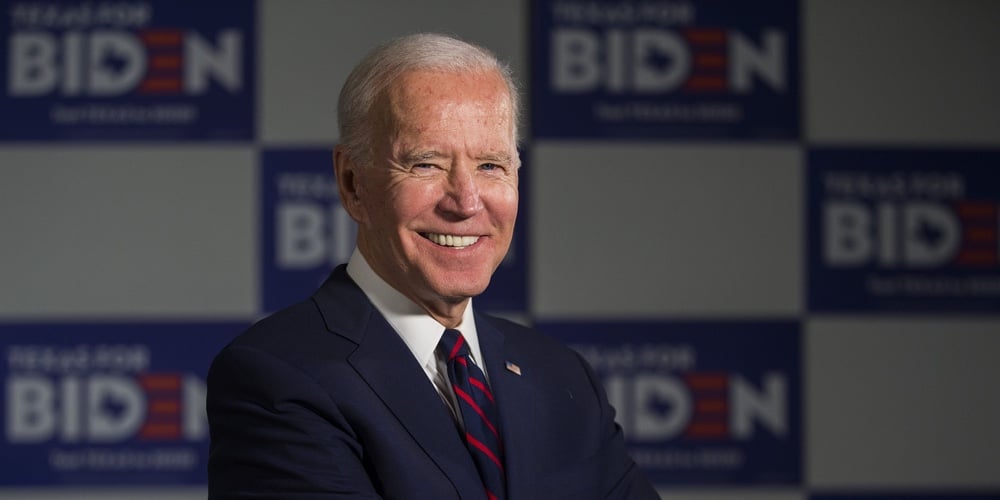

In a hotly contested election, former Vice President Joe Biden has been elected by the American people to serve as the next President of the United States. With the lame duck session now underway, NAFCU remains committed to supporting credit unions and championing their needs at the federal level.

While President-elect Joe Biden begins his transition to the White House, NAFCU is hitting the ground running to ensure policymakers are well informed of the benefits credit unions provide their members and local communities. In fact, we have already been in communication with the Biden campaign to tout the credit union industry and how they can better serve millions of Americans – now, while facing financial hardships and uncertainty in the wake of the coronavirus pandemic, and well into the future.

With a Biden Administration now set for the next four years, we can expect some changes in leadership at the CFPB and NCUA as well as a new outlook and approach to financial regulation. However, NAFCU will fight to ensure credit unions, as consumer-centric lenders, are not further burdened by regulations meant to prevent the egregious practices of bad marketplace actors.

In the immediate future, negotiations on a possible Phase 4 relief package continue. NAFCU's priorities remain the same, regardless of the election outcomes:

- providingrelief from credit unions' member business lending (MBL) capso they can provide more credit to small businesses impacted by the coronavirus pandemic;

- providing emergency funding for the Community Development Financial Institutions (CDFI) Fund and Community Development Revolving Loan Fund (CDRLF) to better serve underserved and lower-income communities;

- modernizing the E-SIGN Act;

- extending several provisions included in the CARES Act related to theNCUA's CLF, troubled debt restructurings, deposit insurance,CECL, andcapital flexibility; and

- simplifying the PPP loan forgiveness processfor loans under $150,000 and addressing the issue of economic injury disaster loan (EIDL) advances being deducted from a borrower's forgivable PPP amount.

For the lame duck session, credit unions should keep an eye out for:

- Government funding:Afterpassing a continuing resolutionto keep the government funded through Dec. 11, Congress is expected to focus on spending discussions now that the election is over. While the House haspassed its fiscal year 2021 spending package, the Senate has yet to do so.NAFCU will advocate for full funding for credit union priorities, as well as caution against House-passed provisions the association is opposed to, such as a pilotpostal bankingprogram.

- Bank Secrecy Act (BSA)/anti-money laundering (AML) and beneficial ownership reform:NAFCU joined with dozens of other organizationsrecently to urge leaders of the Senate and House Armed Services Committees to include BSA/AML and beneficial ownership reforms in the fiscal year 2021 National Defense Authorization Act (NDAA). The groups specifically called for the inclusion of the Corporate Transparency Act – included in theHouse-passed NDAA– which would create a beneficial ownership registry.

- Defense credit union leases:Another provision of the NDAANAFCU is engaged on where credit unions have bipartisan support: Rejecting thebank-sought provision – included in theSenate's NDAAbut not the House's –that would require the Department of Defense (DoD) to treat banks, including big ones like Wells Fargo and Bank of America, the same as credit unions when it comes to nominal leases on military bases. This provision was also included in the Senate's NDAA last year, but NAFCUsuccessfully kept it from being includedin a final version of the bill that resulted from the conference committee.

- NCUA Board nomination:While Senate consideration ofKyle Hauptman's nominationto serve on the NCUA Board could be impacted by the results of the election, NAFCU believes the chamber could consider it on the floor during the lame duck session.

Overall, credit unions are in a strong position and NAFCU is working daily to ensure our cooperative industry remains in high regard with policymakers. For credit unions looking to join NAFCU's advocacy, the association has anew resource page availableand itsGrassroots Advocacy Centerto ensure candidates understand the issues facing the industry and our priorities.

We are humbled by credit unions support of our association, and we will continue to fight for the credit union industry in Washington, D.C.