The average age of credit union members is now over 53, presenting a significant challenge for credit unions aiming to secure their future. As current members age, attracting a younger demographic becomes critical. Fortunately, credit unions can look to an unexpected source for inspiration: Stanley, the century-old company known for its rugged outdoor gear. Stanley's resurgence with millennial moms provides valuable lessons on how to refresh a brand, solve modern problems, and build a vibrant, engaged community for the future.

Stanley’s transformation: Making hydration cool

Stanley, founded in 1913, was long associated with durable, utilitarian thermoses popular among outdoor enthusiasts and workers. However, the brand's recent revival is a masterclass in understanding and leveraging modern consumer dynamics. Stanley transformed its image by tapping into the needs and preferences of millennial moms, making hydration not just important, but cool. Through vibrant colors, stylish designs, and a focus on practicality, Stanley made their products desirable to a new, younger audience.

This transformation wasn’t just about aesthetics; it was about solving real problems. Busy moms needed durable, spill-proof, and portable drinkware that could keep up with their active lifestyles. By addressing these needs, Stanley didn’t just sell thermoses—they became a part of a lifestyle, embraced by influencers and spreading rapidly on social media. And it didn’t just stop with the moms; kids followed suit bringing an even younger group of fans.

The credit union aging problem

Similarly, credit unions face the challenge of modernizing their appeal to attract younger members. The financial landscape has shifted dramatically, with millennials and Gen Z seeking digital solutions, convenience, and meaningful engagement. Traditional banking methods and old-school marketing approaches are no longer sufficient.

As Stanley made hydration fun and essential, credit unions can make financial management engaging and relevant for younger generations. The key is understanding the unique needs and pain points of these demographics and offering solutions that integrate seamlessly into their daily lives.

Solving modern problems with digital tools

Much like Stanley’s products, the tools for teaching children about money have remained largely unchanged. In a world where cashless transactions dominate, traditional methods like piggy banks are becoming obsolete. To effectively reach and engage younger members, credit unions need to offer modern, digital solutions.

Millennial moms, who played a crucial role in Stanley’s resurgence, are also looking for tools to help them manage household responsibilities, motivate their children, and teach them about money and responsibility. Credit unions can position themselves as partners in this journey by offering chore, allowance, and financial education apps and programs.

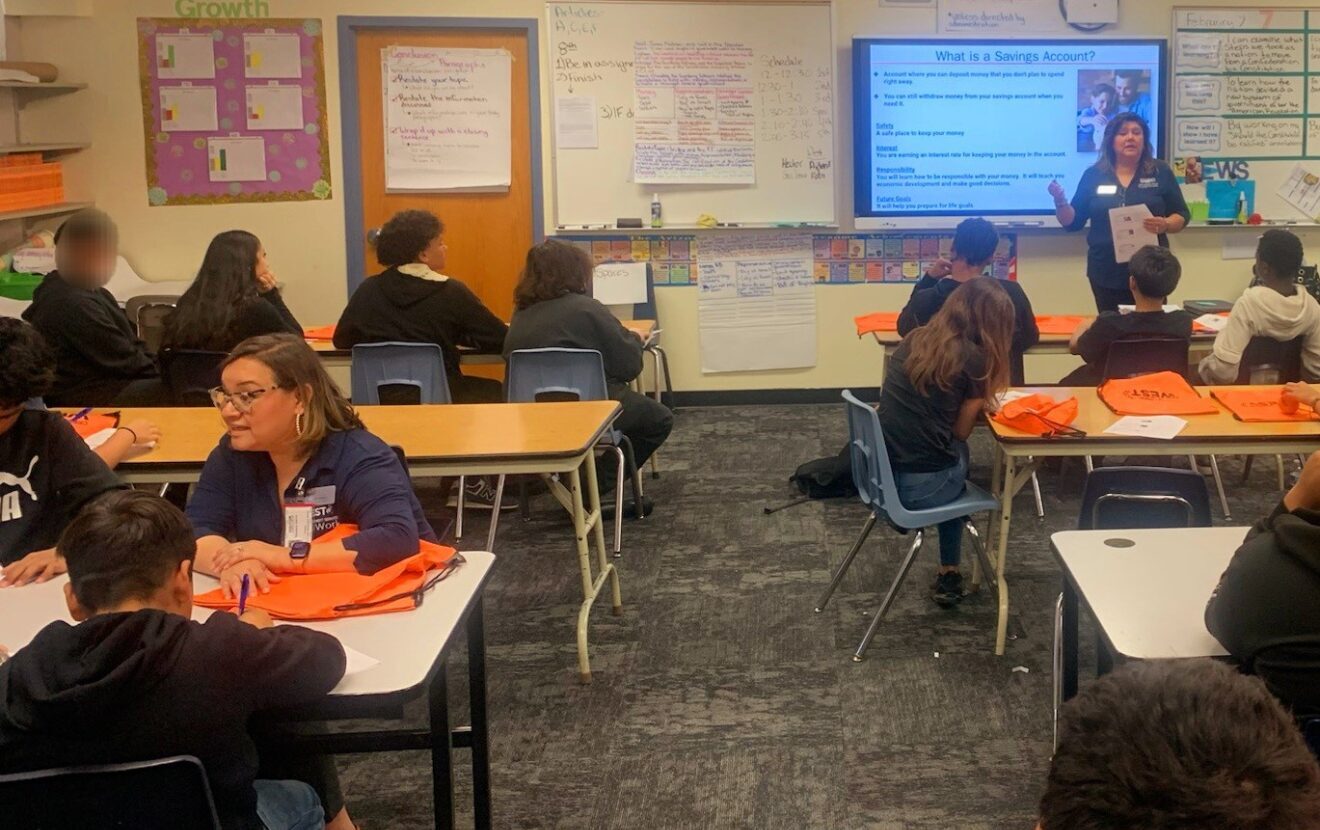

Introducing financial education early

It’s crucial to introduce children to digital banking and financial literacy early on. Programs that teach the basics of online transactions and gradually increase responsibility help children develop essential skills without the security risks associated with giving young kids debit cards. Digital tools can provide a safe, controlled environment for children to learn about managing money.

Chore and allowance apps, for example, are an excellent starting point. These apps help children track their earnings, understand the value of money, and learn budgeting skills. Parents can monitor their children’s spending and savings habits, set savings goals, and teach responsible financial behavior—all through a digital interface that kids find engaging and intuitive.

Building a vibrant community

Credit unions have a unique opportunity to build a vibrant community by integrating financial education into their offerings. By providing resources like chore and allowance apps, credit unions can help families instill healthy financial habits in children from a young age. This not only attracts younger members but also fosters loyalty and trust among families.

Millennial moms, who are often the primary decision-makers for their households, present a particularly promising target demographic. They are deeply engaged in their children's education and extracurricular activities, often receiving communications from schools and parent-teacher associations. This pooling effect makes it easier to reach them through school-based programs and community initiatives. By tapping into these networks, credit unions can effectively communicate the benefits of financial education tools and build relationships with families.

Conclusion: A path forward

Credit unions can take a page from Stanley’s playbook by identifying and addressing the needs of Millennial moms and their children. By making financial education engaging and relevant, credit unions can attract younger members and ensure their long-term viability.

My First Nest Egg, an award-winning digital financial education platform, offers credit unions the tools to achieve this transformation. My First Nest Egg runs incredibly successful campaigns through public schools to engage with parents and start building the relationship from day one. By providing customizable materials and resources specifically designed for families, My First Nest Egg empowers credit unions to become leaders in youth financial education. Partnering with My First Nest Egg enables credit unions to connect with millennial moms, offering modern solutions to age-old problems. This collaboration not only secures the future of credit unions but also builds a financially literate, engaged community. If you’re looking to revitalize your membership and build a strong foundation for future generations, My First Nest Egg is the partner you need.