The challenges presented to credit unions in the effort to grow and retain member relationships are significant. Consider these stats:

- About 79% of consumers consider their financial institution as transactional. They don’t see it as relational.

- For every 1 loan credit unions have, 46 loans exist with another provider.

- The majority of a credit union’s members utilize just 1-2 products with them.

And, with six financial institutions within a 10-minute drive and many more operating virtually, competition for members’ business is fierce.

Member data is key to solidifying relationships.

Competing in today’s environment can be daunting. Top that off with the fact that, now more than ever, the expectation of consumers is that businesses understand their needs and know their preferences. This is key to growth and retention. To truly create an engaged member, credit unions need to understand these things and strategize accordingly.

That’s where member data comes into play. But how insightful is that data if it’s just the data based on your members’ current accounts and the majority of those members only carry one or two products at the credit union? Not very. While that data provides good information on how a member does business with the institution, it does not inform who that member is, or what additional opportunities may exist.

Assemble data to grow your knowledge.

Supplemental data, like demographics, psychographics, product models and even credit bureau data, can close that gap when assembled properly from silos. With it, credit unions are empowered to relate to and engage with their members at a higher level. It will fill in those missing blanks and equip them with the insight necessary to identify opportunities, communicate more relevantly and create an elevated member experience.

So often, credit unions struggle to improve share of wallet with members. The majority fall short of adopting any additional products beyond their second. But with external data, credit unions can gain insight into the products and services its members are most likely to be in the market for. These opportunities can be identified with credit bureau data—who has an existing loan or has applied for a loan elsewhere? Through product models—which members have a high propensity to be in the market for this loan right now? And even psychographics—which lifestages show a likelihood to be needing a particular loan based on current and ensuing life events? These data sources provide a solid starting point to craft a meaningful conversation with members based on their current situation, rather than on the credit union’s monthly loan quota. Moreover, they can boost response and return on efforts to grow product adoption. In reviewing results across several campaigns focused on loan savings at a variety of credit unions, utilizing loan propensity models to create an audience, average response was at 2.72% with 707% ROI. This compares to an overall ITA average response of 0.82% and 441% ROI.

Credit unions also have an opportunity to better understand who it is that they appeal to. It’s fairly easy to define their target audience—those engaged members utilizing a number of products and services. Demographics and psychographics paint a picture of that member. Once that is known, “look-alike” members who aren’t engaged can be targeted in hopes of growing those relationships. One credit union experienced this firsthand. The marketing team implemented a program with the objective of reeducating and reengaging less active households. During the first year of the program, a much broader audience was targeted. In the second year, after profiling respondents based on external data, they tweaked criteria to focus in on a narrower audience. This resulted in an increase in response rate of 49% (from 3.99% to 5.94%). ROI increased 741% (from 134% to 1,127%).

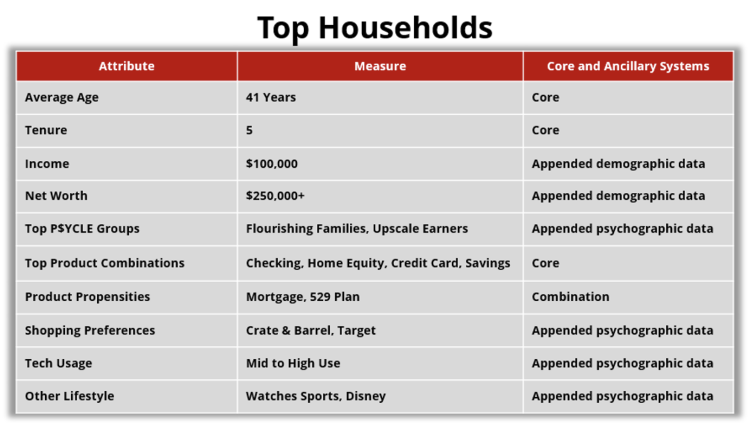

It doesn’t stop there. With psychographic data, credit unions have the ability to understand their members on a higher level thus setting you apart from large institutions. Where do members shop? What do they read? How do they prefer to do business? With this level of data, credit unions are armed with the information necessary to create specific, relevant messages and offers using the proper channels based on their members’ preferences. This data can also be used to help identify new product and service needs and potentially inform the use of banking channel strategies. The example above provides an overview of a credit union’s top households through the mining of core, demographic and psychographic data. Using all of these sources brings the member to life and helps in the credit union’s effort to better understand its top members’ needs and how to most effectively reach them with messaging and channels.

The gap filled by supplemental data can be a game changer if used to identify opportunity and create meaningful interactions. The collective outcome is an elevated member experience that will lead to improved growth and retention.