By Michael E. Fryzel, NCUA

The end of the year is usually the best time to look back, review accomplishments,reevaluate goals and objectives andreassess a game plan as you move forward.

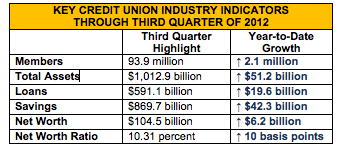

2012 has been a good year for most credit unions. Through the third quarter, credit union networth grew 6.4 percent to $104.5 billion from $98.3 billionat the start of the year. Industry total assets increased 5.3percent to $1,012.9 billion from $961.7 billion in the sametimeframe, as total savings rose 5.1 percent to $869.7 billionfrom $827.4 billion.

Credit union investments, cash deposits, and cash equivalentsrose 7.5 percent to $378.7 billion from $352.1 billion duringthe first nine months of the year. Total loans were on the riseand expanded by 3.4 percent to $591.1 billion, up from$571.5 billion. Lending has now increased for six consecutivequarters. Additionally, credit union net income for the firstthree quarters of 2012 climbed to $6,351.2 million, exceedingthe industry’s total 2011 earnings of $6,275.8. However, oureconomic recovery still has a ways to go and there will bechallenges to face in the coming year.

NCUA has tried to lessen the regulatory burden with changesin numerous regulations to allow credit unions to better servetheir members and not be constrained by over excessivegovernment requirements. We have carefully listened toindustry comments and concerns about proposed regulationsand responded requesting additional information and arewithholding final action. In addition, the new National Supervision Policy Manual will ensure fair and consistentexamination procedures across the country, improving theexam process with the goal of making it fair and equitable.

So there has been some improvement and good things forcredit unions as we look back over the year.But there have been some setbacks and struggles. Congresshas not yet approved an increase in member business lendingand the prospects of its approval in the near future aren’tbright. Legislation to permit supplemental capital for allcredit unions is still a ways off.

Perhaps it’s time to not forget those progressive initiatives but place them on the back burner and reassess.

What do credit unions really need to compete as not-for-profitcooperative financial institutions in the 21st century?What enhancements could be made to the federal credit unioncharter that will allow for growth, advancements in memberservice and further improve credit unions stature as thepremier financial services movement in the country?

Perhaps that should be the challenge to credit unions and thenational organizations that represent them. Together, theyshould develop a strong legislative program that will containcredit union enhancements clearly showing that they willimprove financial services and products for the citizens of ourcountry. They should work together and in tandem to developa sound legislative program to be presented to Congress earlyin the new session.

Call Out Quote

NCUA has tried to lessen the regulatory burden with changes in numerous regulations to allow credit unions to better serve their members and not be constrained by over excessive government requirements.