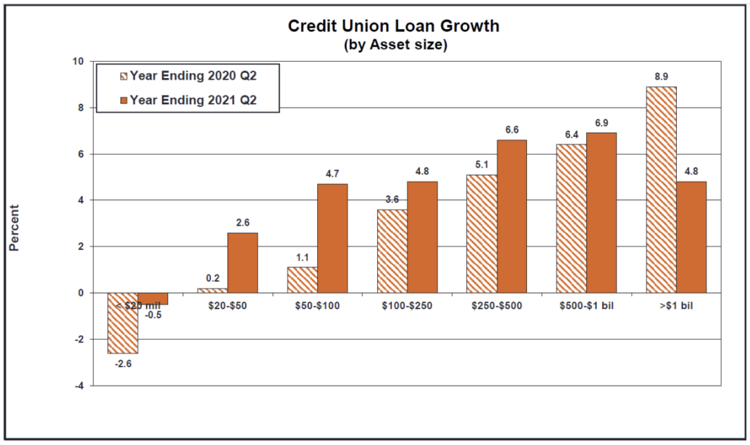

According to CUNA Mutual’s Credit Union Trends Report – December 2021, credit union consumer loan growth peaked at 10.5 percent in 2016. It has decreased annually since then, reaching 5.9 percent in 2021. Drilling down a bit further, the chart below reflects the loan growth challenges smaller credit unions have faced during the past two years.

We’ve just finished our 2021 strategic planning sessions, including many with smaller-sized credit unions – some with loan growth challenges and some that found extraordinary lending success, especially when compared to their asset-sized peers. Leaders frequently ask us, “Why the disparity between successful and unsuccessful lenders?” The purpose of this article is to highlight the lending behaviors consistently exhibited by best-practice lenders.

Anatomy of superstar small credit union lenders

In addition to the many strategic business planning sessions we facilitate, we also collaborate with a remarkable group of colleagues like Bo McDonald at Your Marketing Company. Bo and company witness the same industry trends and provide marketing solutions to support these lending superstars. Our collaborative group of smaller credit union advocates gets to see what makes high-performing lenders stand out from the mediocre. Our collective observations are that high-performing smaller credit union lenders are very good at one or more of the following:

- Cultivating a robust internal lending culture. These credit union shops consistently live a set of beliefs, standards, and behaviors that contribute to lending success, including an organization-wide belief that the credit union exists to provide affordable access to credit to as many members as possible. You’ve heard of a “mobile first” strategy – well, these successful small credit unions have a “lender first” focus that drives everything they do. Their standards include a high level of awareness of potential lending opportunities revealed by digging: daily review of ACH records to find competitor loan payments, reviewing member credit reports and other data to find loans to cross-sell, and engaging in conversations with members to reveal loan opportunities. These teams are comfortable with these behaviors and are motivated to find each loan opportunity. They have high loan growth expectations, keep score, and report daily. Everyone from tellers to board members knows exactly how they’re performing. Other behaviors include an appetite for risk, as they desire to approve as many loans as possible. They hate to say “no,” and find effective ways to manage risk and ramp up loan yield. They are bold and have flexible lending policies that support more loan growth opportunities.

- Pursuing a more clearly defined target market in a market where they can efficiently compete. These teams do not try to be all things to all people. Most don’t participate in indirect lending, and most are limited in their ability to drastically expand mortgage lending. However, they are expert consumer lenders, especially in used auto and personal loans. When asked, they can tell you their unique niche. Common examples: include younger, working-class borrowers or low- to moderate-income, minority consumers. These lenders have a good understanding of the financial needs and challenges these unique consumers face. They tailor their products and services to these groups. They don’t waste time or money on other highly competitive demographics (e.g., high credit, high income borrowers). Research can identify niches to find underserved segments where credit unions can compete and win for these loans.

- Utilizing a professional marketing firm. For this point, I’ve included insights from my colleague Bo McDonald at Your Marketing Company: Sometimes it’s hard to see the forest for the trees. When you’re so close to managing the ins and outs of your credit union, it can be a strain to ask the critical questions and gain a clear understanding of your member’s needs and your true value proposition. Who are your ideal members? Is it clear to each member segment what solutions you bring to the table for them? Why should they trust and engage with your credit union? Working with an outside agency is a great way to balance your key knowledge with a dose of outside perspective and assure the best possible position for your credit union’s growth.

Here are three notable examples of small credit union lending stars:

Lending Culture: Lewis Clark Credit Union

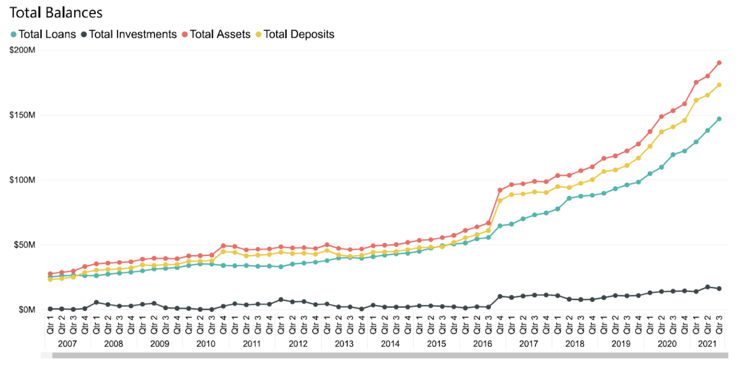

This credit union serves a vast rural area in north-central Idaho and eastern Washington. The graph highlights the credit union’s 15-year loan growth trend. While the overall loan growth rate has decreased since 2016, LCCU’s lending trend is running in the opposite direction. This small credit union is quickly on its way to becoming a midsized credit union. You can learn more about this credit union’s lending culture here.

Niche Market: Ironworkers USA FCU

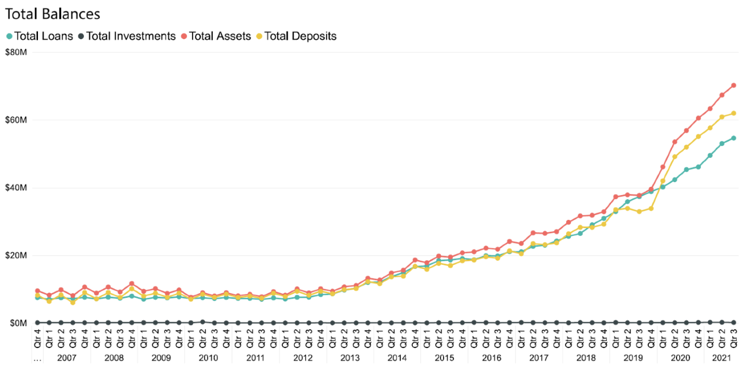

This unique credit union busts conventional wisdom that single SEG credit unions can’t thrive. Ten years ago, this credit union had fewer than 10 million dollars in assets and was in trouble. NCUA wanted it to merge. Fortunately, the credit union’s leadership doubled down on their purpose to serve ironworkers and their families, and the results are spectacular. In 2018, the credit union was doing so well at serving ironworkers remotely that the NCUA approved a nationwide charter for ironworkers located anywhere in the country. The mantra to members is simple “You’re union, we’re union, we get it.” This credit union understands the financial needs and challenges of ironworkers better than anyone else! Loan policies are uniquely tailored to a group that frequently faces income volatility and features humble financial backgrounds. Assets today exceed $70 million, and the 15-year trend highlights the credit union’s lending success. You can read more about this top-performing credit union here.

Marketing Niche: Mint Valley FCU

Here, Bo McDonald is back with a success story from one of his clients: How many small credit union leaders face this same problem? “We’ve been here since 1936, and still no one knew who we were or where we were,” Dori Harvel, CEO of the $23.6 million Mint Valley Federal Credit Union. “That was a big problem.” After a year of working with YMC through its marketing plan and the additional challenges the pandemic brought, Mint Valley shifted from meek to confident. And from negative loan growth to more than 13% loan growth! From little member growth to 6.7% membership growth! From net income of 0.37% in March 2020 to 0.59% in March 2021! And delinquencies are holding to a reasonable 0.84%.

“You’ve got to be willing to change,” Harvel reflected. “Change is hard for everyone, but ultimately my goal is I want it to be fun for everyone to come to work and serve our members. By doing all those different things, we had fun stepping out of our comfort zone to reach out to the community, and it really boosts the team’s confidence when they hear members’ appreciation and the comments that Mint Valley has been life changing for them.” “Mint Valley is one of my favorite success cases,” McDonald said, “and a lot of that has to do with Dori’s leadership and her team’s willingness to break from ‘what we’ve always done.’ So many small and relevant credit unions could keep the doors open and the lights on by stepping outside of ‘what they’ve always done.’ The YMC team loves being a part of success stories like Dori’s – it builds our confidence, too!”

Why it matters

A vibrant credit union movement is dependent on successful small credit unions. Small credit unions effectively fill lending voids in most local communities. Small credit unions amplify the good work accomplished by all credit unions, and they help differentiate the credit union “movement” from the banking “industry.”

The work these small credit union superstars are doing is not easy – it’s difficult. They face the same capacity challenges as their peers do. What’s different is that they have prioritized lending and find meaning as lenders. If your shop isn’t growing loans, you need to shake things up to make changes. These changes to strategic priorities, culture, staffing, branding, risk, and accountability are heavy lifts. But what’s the alternative?

If you’re discouraged, find hope in those credit unions that have gone before and make the changes needed to improve your lending results. It won’t be easy, but when profitable growth increases and you notice improved member service testimonials, it will be worth it.