Even before COVID-19, risk management was receiving renewed focus at many institutions. While the general principles and goals of risk management have been relatively static, technology, techniques and the potential alternatives institutions have access to have evolved.Many financial institutions are revisiting how loan participations can be part of a proactive, regularly-used, risk management toolkit to fine-tune their balance sheets. This is especially true given the comparative ease, increased accessibility, and lower costs of undertaking loan participations today than ever before.Active engagement in loan participations, or having the ability to become active, provides institutions with a more robust menu of risk management options, especially when other alternatives have become unavailable or have material drawbacks.

Depository institutions often rely upon two metrics to optimize therisk/return goals for their balance sheets: liquidity, asset utilization, and asset diversification.While in theory, these measures of risk are approached both jointly and in a dynamic, unified fashion with an institution’s liability management, including potentially other hedging activities, in practice, this is often not the case. The relatively static value of an institution’s liabilities coupled with a lack of control over deposit activity causes there to be much greater focus on the management of assets where institutions exercise greater control along with the terms under which credit is extended. This practical result drives how loan participations can and should be used strategically for managing liquidity and asset utilization.

Participations: Tactical Remedy or Forward Planning Tool?

For managing liquidity and targeting capital ratios some institutions choose to utilize loan participations reactively in response to an imbalance that has already occurred, rather than as part of an ongoing proactive management strategy. Below are examples of unplanned balance sheet situations where institutions commonly seek the loan participation market’s mix of moderate execution speed, low transaction costs, and additional income generation potential.To the point, alternative methods of balance sheet management are more disruptive to members, too slow, or simply nonviable over the long term from an income generation perspective.

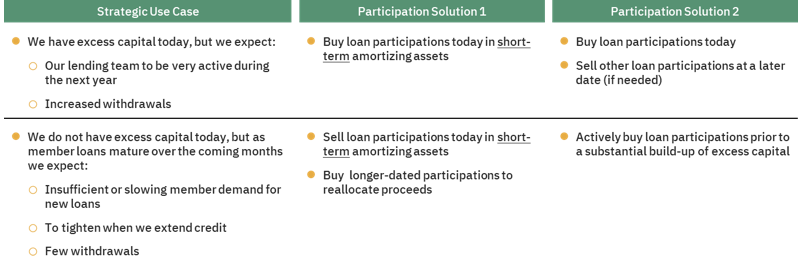

Notwithstanding the benefits of using loan participations reactively, there are far greater advantages to be had from using loan participations proactively. Using loan participations proactively as a balance sheet management tool enables an institution to take into account the future trajectory of deposits and lending activities.Below is a sample decision matrix for proactive use of loan participations for an evolving set of capital needs over a longer period of time:

Over the past two years, excluding the COVID-impacted quarters of 2020, it was fairly common for institutions to hold large amounts of excess capital in anticipation of accelerating their lending activity and deploying that surplus over a period of 6 to 12 months. This delayed use of this capital is terribly inefficient. Simply put, rather than have this capital temporarily invested in low-yielding securities, purchasing loan participations in short-term, amortizing assets with higher yields results in a superior outcome as it satisfies the needs of such an institution’s lending team while providing material incremental income.

Over the past two quarters of 2020, between the gyrations of global markets and increasing concerns over a looming recession, many financial institutions may find themselves in a situation where they are (more than) adequately capitalized from a regulatory perspective, but where they have made an internal decision to build even larger capital buffers. Choosing to sell participations today and subsequently be able to continue to extend credit to members seeking loans in the coming months or have the flexibility to purchase other participations is both a stronger risk management strategy and less disruptive to members vis-à-vis the passive approach of slowly building a larger capital buffer by tightening credit beyond what is necessary.Moreover, a credit union that explores selling loan participations can set its own price consistent with its objectives. If there are no buyers at the desired price, the credit union can then pursue other balance sheet management alternatives with very little opportunity cost. In utilizing loan participations as the preferred approach for managing these risks, the institution prioritizes satisfying all of its own parameters for achieving its goals, rather than laying itself at the mercy of current conditions in the securities market. The longer trading timescales, and ultimate discretion on asset selection provide credit unions with substantial trading flexibility.

Conclusion:

Risk management is best approached in a forward-looking manner that takes into account an institution’s goals as well as prevailing market conditions. Given the increased ease of undertaking loan participations, becoming and remaining active in participations provides institutions with a robust balance sheet management tool to achieve more of their goals in any market environment. While participations continue to retain their use to remedy unplanned, break-fix situations, the additional benefits of more strategically and regularly utilizing loan participations are substantial.