Credit union members nationwide are more likely to say that credit unions improve their financial well-being compared to customers of other financial institutions, according to a new white paper issued today by Credit Union National Association (CUNA).

“We have data that shows credit unions return billions of dollars to their members and their communities, but it is especially meaningful to hear how members actually feel about the impact credit unions have on them personally,” said CUNA Chief Economist Mike Schenk. “The findings also illustrate the stark difference between credit union members and non-members.”

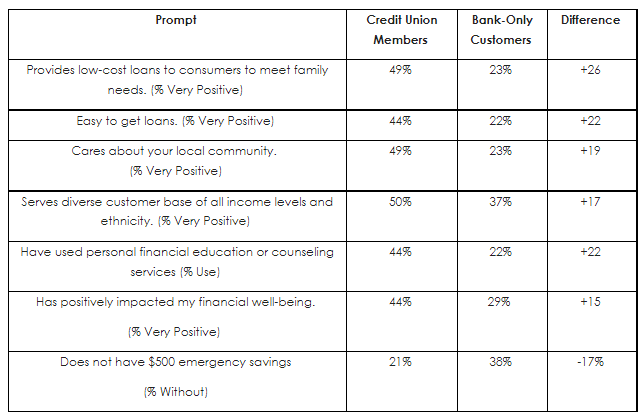

The white paper, which consists of a survey of 2,500 voters, finds that credit union members are more likely to say that their financial institution has a “very positive” impact on their financial well-being than those who identified as bank-only customers (44% to 29%).

Respondents were also more likely to associate their credit union with serving a socioeconomically diverse membership, granting easier access to low-cost loans, and having a more meaningful connection with their community. Bank-only customers were more likely to report that they don't have $500 in savings to cover an emergency, long a measure of financial well-being.

The white paper shows that credit union members are also twice as likely to take advantage of financial counseling and education classes, engaging with their not-for-profit, member-owned credit union to build a more stable foundation for success.

The white paper is available online at cuna.org/advocacy.