Burlingame, CA (September 18, 2024) |

Data collected by risk management firm G2 Risk Solutions (G2RS) in the second quarter of 2024 showed bankruptcy filings in the US rose again, increasing 9.1% from the year's first quarter. Bankruptcy filings have continued an upward trajectory over the last two years.

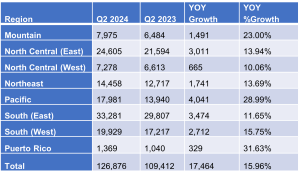

Total filings for the first two quarters of 2024 were 243,161, compared to 209,296 for the first two quarters of 2023. This represents a 16.2% YoY increase.

“While bankruptcy filings increased in every region of the US during the first half of the year, we are witnessing diverse trends across the states,” said Ryan Sanders, who leads relationship management with US financial institutions for G2RS bankruptcy intelligence solutions. “Some states are showing consistently rising bankruptcies, while others remain stable. Still, others report fluctuating rates that don’t fit a strict pattern. We have not yet surpassed record-high, pre-pandemic bankruptcy levels, but we’re continuing to monitor the steady climb we’ve seen since 2022.”

Regional quarter-over-quarter data

In terms of total quarterly filings, the North Central-East part of the country experienced the largest volume increase in Q2 2024. The North Central-East region includes Illinois, Indiana, Michigan, Ohio, and Wisconsin. In terms of percentage increase, the Mountain region, composed of Arizona, Colorado, Idaho, Montana, New Mexico, Utah, and Wyoming, was the largest, increasing by nearly 30% quarter-over-quarter.

Regional yearly data

When looking at total bankruptcy filings to date, the Pacific region of the country, composed of Alaska, California, Hawaii, Nevada, Oregon, and Washington, had the largest growth in 2024, increasing 13% year-to-date. When comparing Q2 2024 against Q2 2023, the Pacific region again had the most significant YoY increase at 28.99%. California led the Pacific region in filing volume and percentage increase for 2024 at 15.6%.

States with highest bankruptcy growth by volume and percentage

Mountain

- Montana (+62.3%) led in percentage growth.

- Colorado (+628 units) experienced the largest volume growth.

North Central (East)

- Wisconsin (+19.4%) led in percentage growth.

- Ohio (+777) experienced the largest volume growth.

North Central (West)

- South Dakota (+46.0%) led in percentage growth.

- Kansas (+282) experienced the largest volume growth.

Northeast

- Maine (+37.4%) led in percentage growth.

- New York (+406 units) has the largest volume growth.

Pacific

- California (+15.6%) led in percentage growth.

- California (+1,587) experienced the largest volume growth.

South (East)

- District of Columbia (+47.2%) led in percentage growth.

- Florida (+620) experienced the largest volume growth.

South (West)

- Oklahoma (+25.3%) led in percentage growth.

- Texas (+645) experienced the largest volume growth.