Englewood, CO (April 22, 2025) |

iLending, a national leader in automotive refinancing, is pleased to share its Spring 2025 report on the State of the Auto Refinance Industry. This semi-annual review combines internal trends with broader market data to help consumers, partners, and lenders better understand the shifting dynamics of vehicle finance and refinancing.

As Q2 2025 begins, auto refinancing continues to present meaningful financial relief for consumers, especially in a market shaped by declining car values, global tariff uncertainty, tightened lending, and waning consumer confidence.

“Economic headwinds persist, but so does our mission to help families save money through smarter auto loan solutions,” said Nick Goraczkowski, President of iLending. “Consumers are making more strategic decisions, and refinancing is often the easiest lever to pull for immediate relief.”

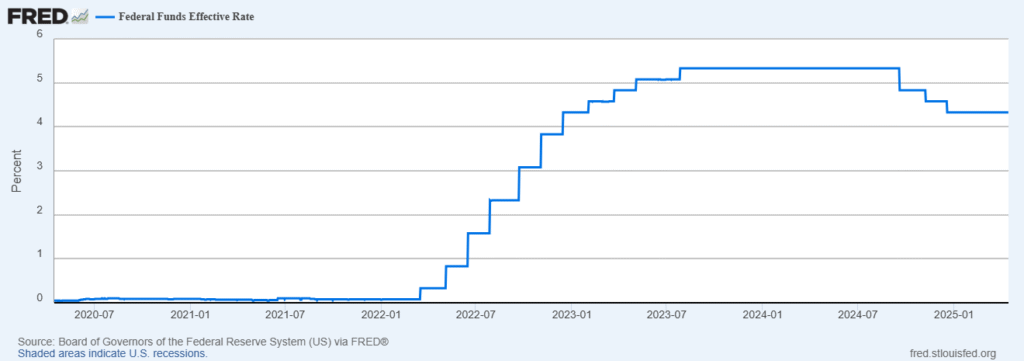

Interest Rates Environment

The Federal Reserve has maintained interest rates at multi-decade highs since mid-2023. While most economists now anticipate no additional cuts until late 2025, three rate reductions totaling 1% occurred at the end of 2024. iLending continues to assist consumers who secured high APRs by helping reduce monthly payments through term extensions, improved credit profiles, or lender-driven promotions.

While rates remain elevated, payment relief is still very real, with the average iLending refinance saving clients $145 per month—providing much-needed cash flow flexibility.

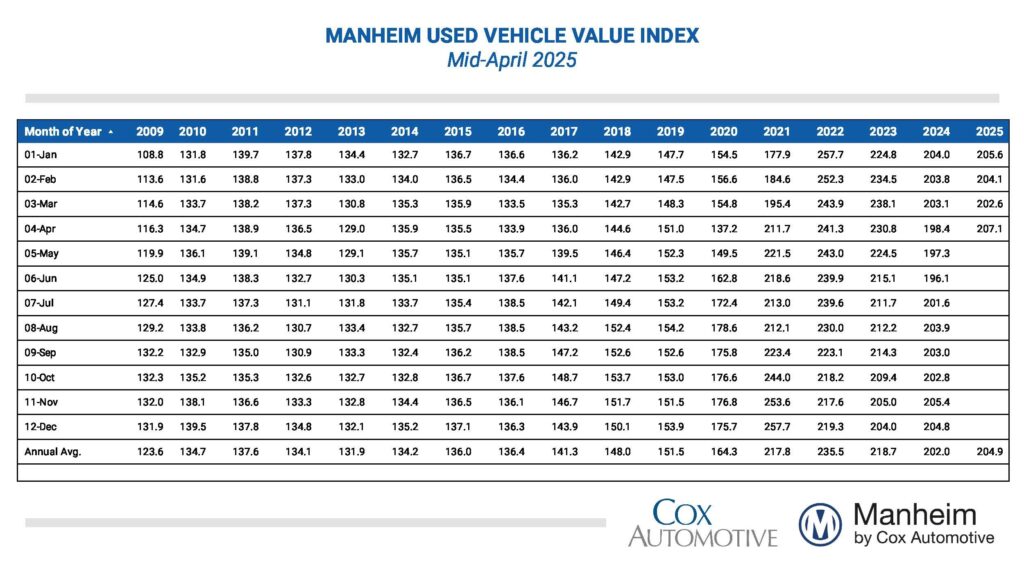

Vehicle Values & the Manheim Index

Used vehicle prices have trended downward, while also entering a period of normalization. While overall values have declined, iLending has observed signs of stabilization. However, if the proposed tariffs take effect as planned, they could significantly impact future vehicle values. According to the Manheim Used Vehicle Value Index, wholesale prices are down 6.8% year-over-year, marking a reversal of the sharp increases seen during the pandemic.

This shift has impacted loan-to-value ratios and creates urgency for those at risk of going upside-down on their loans. iLending is seeing more consumers looking to refinance before values dip further.

Global Tariffs & Automotive Supply Chain Concerns

Ongoing trade tensions—particularly potential tariffs on EVs and Asian vehicle components—are injecting new volatility into the market. Consumers and lenders alike are monitoring the possible impact on vehicle pricing, availability, and cost of ownership, all of which may further push consumers toward keeping and refinancing their existing cars rather than trading in.

Lending Environment

Lenders have remained cautious, continuing to tighten approval criteria as risk profiles fluctuate. However, competition among refinance lenders is healthy, especially for borrowers with improved credit scores, consistent payment history, or equity in their vehicles.

“We’re seeing tempered optimism from our lender partners,” said Cedric Moore, Director of Lender Relations at iLending. “Loan performance is stabilizing, and many lenders are expanding programs to regain market share.”

Consumer Confidence & Household Behavior

Consumer sentiment has weakened in 2025, according to recent University of Michigan Consumer Confidence Index readings. Inflation fatigue, high interest rates, and economic uncertainty are shifting household behavior. Consumers are increasingly focused on reducing recurring monthly expenses, making auto loan refinancing an attractive and proactive option.

Remaining 2025 Outlook

With used vehicle values softening and global economic indicators remaining uncertain, iLending projects continued strength in auto refinance activity through 2025. As consumers seek ways to manage household expenses and reduce monthly obligations, digital refinance solutions are gaining traction. iLending’s streamlined prequalification process, rapid approvals, and consumer-first platform position the company to meet rising demand. The shift toward low-friction, tech-enabled savings options reflects a broader trend in financial services—one that iLending is well equipped to lead.

Summary

Based on current conditions, iLending assesses the opportunity to save through auto refinancing as:

- Above Average for sub-prime and near-prime borrowers with equity or improved credit

- Moderate for prime borrowers, who may benefit more from payment flexibility than rate reduction

Despite high rates, refinancing can offer payment relief through term extension, payment skips, and more favorable lender programs.

iLending remains committed to helping clients ease their monthly burdens as they navigate a complex and evolving auto finance market.