WASHINGTON,, DC (October 11, 2024) |

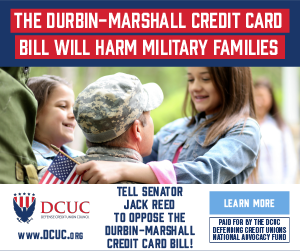

The Defense Credit Union Council’s, DCUC, Defending Credit Unions National Advocacy Fund has launched a targeted digital advertising campaign to highlight the risks and concerns of adding Senator Dick Durbin’s (D-IL) and Senator Roger Marshall’s (R-KS) proposed Credit Card Competition Act, CCCA, language to the 2025 National Defense Authorization Act, NDAA.

The advertising campaign reaffirms DCUC’s position that any CCCA-like amendments could jeopardize important defense-related legislation while attempting to enrich the largest multinational retailers at the expense of our Nation’s military and veteran consumers.

“This advertisement campaign allows us to raise awareness of the potentially harmful effects the Credit Card Competition Act could have on service members, veterans, and their families,” said Jason Stverak, DCUC Chief Advocacy Officer. “It also serves as an important tool to inform and

engage the American public, encouraging them to share their voice. DCUC remains at the forefront of this issue, advocating on behalf of our member credit unions and the broader credit union movement.”

“Our National Advocacy Fund is already enabling us to bolster our advocacy efforts such as this targeted ad campaign to combat harmful CCCA legislation and continue amplifying our concerns to key decision-makers,” said Anthony Hernandez, DCUC President/CEO. “It’s imperative Congress, and the American public understand the negative impacts this legislation poses to American consumers, especially those serving or who have served our country.”

Hernandez continued, stating “We will continue to safeguard these communities’ access to safe, reliable financial services that credit unions have provided for decades. DCUC is fiercely

committed to being the driving force in Washington when safeguarding and championing the credit union difference.”

Hernandez shared more about DCUC’s position on this issue in his article titled “Reject the Credit Card Competition Act – Protect Our Military’s Readiness!”

More on DCUC’s Advocacy Efforts: Opposing CCCA-like amendments to the NDAA

DCUC has voiced its strong opposition to any CCCA-type legislation for many years, beginning with the "Credit Card Competition Act of 2022," (S. 4674), and later countering additional Amendments 6201 and 6174. DCUC sent a letter on October 11, 2022, to the U.S. Senate, calling attention to the lack of monitoring compliance concerning the original 2010 Durbin Amendment with respect to debit cards, referencing a 2014 survey conducted by the Federal Reserve Bank of Richmond. DCUC’s letter highlighted how the survey found a sizable fraction of merchants had raised their prices or imposed restrictions on debit card use to avoid paying debit interchange fees.

This did not stop Senators Durbin and Marshall from continuing their attempts to amend the NDAA with their “Credit Card Competition Act of 2023” (S.1838), and through other “must-pass” legislation (H.R. 3881, and later, #1161 to the Military Construction, Veterans Affairs, and Related Agencies Appropriations Act, H.R. 4366).

DCUC, again, promptly responded to these attempts by sending joint trade letters on June 7, 2023, and September 15, 2023, to the Senate Committee on Banking, Housing, and Urban Affairs and the House Committee on Financial Services. In these letters, DCUC emphasized how CCCA-type legislation will hurt consumers while benefiting big box retailers. DCUC and its joint trade partners explained how the amendments would lead to the removal of a consumer’s choice of preferred card network, wringing out the competitive differences among card products, limit popular credit card rewards programs, and place the nation’s private-sector payments system under the micromanagement of the Federal Reserve Board.

DCUC has stayed actively engaged and consistently succeeded in its advocacy efforts on this issue. DCUC reaffirmed its position on proposed CCCA-like language to the 2025 NDAA in a July 15, 2024, letter to Senate Majority Leader Charles Schumer (D-NY) and Senate Minority Leader Mitch McConnell (R-KY).

During the August recess, DCUC’s first digital advertisement campaign on this issue highlighted these concerns to constituents in the Rhode Island region, urging them to call on Senator Jack Reed (D-RI) to reject any attempts to include CCCA-type language in the 2025 NDAA once Congress reconvenes.

For more information on DCUC’s advocacy, visit dcuc.org/advocacy.