SEATTLE, WA (April 29, 2025) |

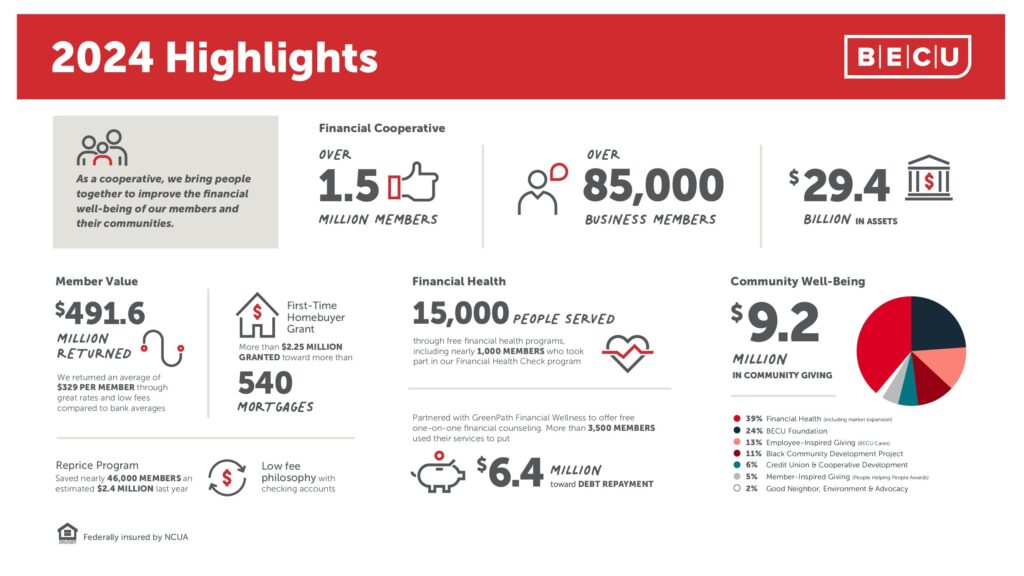

BECU, the country’s fifth-largest credit union, released its 2024 Annual Report to members. The financial cooperative ended the year strong with more than 1.5 million members (up 4% year-over-year), $29.4 billion in total assets and a net worth ratio of 11.84%.

“BECU remains steadfast in our commitment to our members and communities we serve. We support them on their journeys toward financial freedom consistent with the member-owned approach that continues to differentiate credit unions from other financial institutions,” said Beverly Anderson, BECU’s president and chief executive officer. “What began in 1935 as a credit union dedicated to a small group of Boeing employees has now grown to proudly serving over 1.5 million members through 66 Neighborhood Financial Centers and our contact center, as well as video, digital and mobile banking.”

Committed to Members

In 2024, BECU returned $491.6 million to members through lower interest rates, higher deposit rates and fewer fees compared to bank averages, averaging $329 per member. Through its Reprice Program, BECU helped nearly 46,000 members save an estimated $2.4 million. The credit union also supported first-time homebuyers by providing more than $2.3 million in grants toward more than 500 mortgages.

Continuing to grow and invest in its footprint, BECU opened two new Neighborhood Financial Centers (NFCs) in 2024 in Ballinger and Gig Harbor. To date this year, the credit union opened new NFCs in Tacoma, White Center and Spokane South Hill, with future locations planned for Kirkland and Stanwood. Additionally, the installation of digital signature pads in its NFCs and implementation of digital forms added convenience for its members while saving 44% more paper year-over-year for a total of more than 2.5 million sheets of paper saved in 2024.

BECU also bolstered its online banking solutions, including adding new mobile app features to better track spending. Additionally, the credit union opened its Early Saver membership to online applications and rolled out new self-serve debit card features, making it even more convenient for members to bank securely anytime, anywhere.

Community Impact

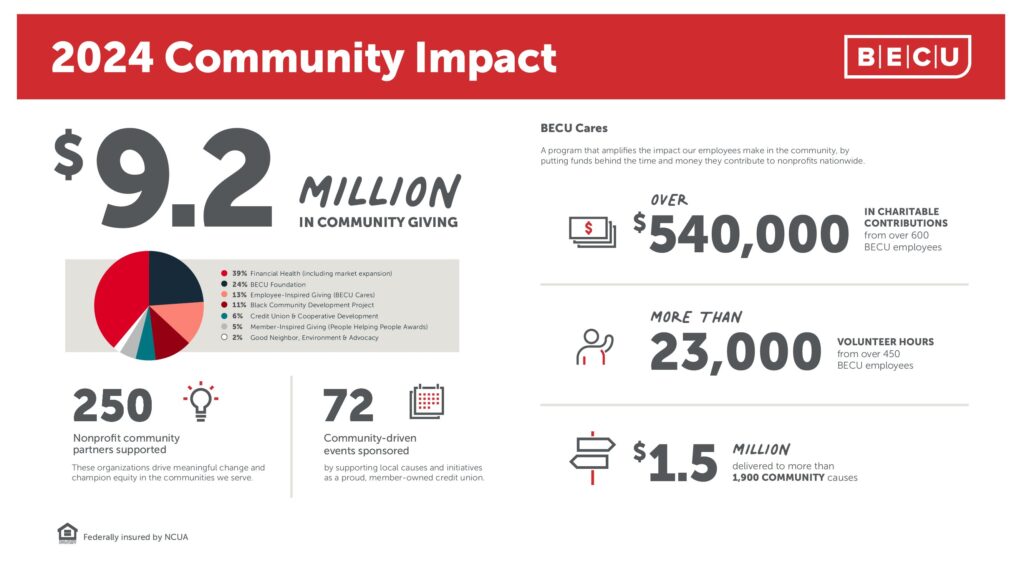

Donations and in-kind contributions to community organizations and partners totaled $9.2 million in 2024, including $450,000 in its annual People Helping People Awards. The credit union also served over 15,000 people through its Financial Health programs, including more the 5,000 members and non-members who attended a seminar, webinar or Financial Reality Fair.

In addition, BECU’s Black Community Development Project awarded $1 million to nonprofits, culminating a five-year, $5 million commitment to improving the overall financial health and well-being of the Black community.

Beyond financial support, BECU also continued its twice-yearly shredding events across the Puget Sound, keeping over 200,000 pounds of paper, 51,300 pounds of electronics and 14,000 household items out of the waste system.

Supporting Employees

Last year, BECU welcomed over 550 new employees, bringing its total workforce to more than 3,200 in service of members and their communities.

The BECU Cares program amplifies the impact employees make in the community by matching employee donations and rewarding their volunteer efforts. In 2024, BECU employees submitted more than 23,000 volunteer hours and donated more than $540,000 in charitable contributions through the program. In total, $1.5 million was delivered to more than 1,900 community causes as part of the BECU Cares program.

More information on BECU’s total commitments and accomplishments is available in the following sections of its 2024 Annual Report:

I. BECU + YOU

II. BECU + COMMUNITY

III. BECU + CREW

IV. BY THE NUMBERS