Another Governmental Affairs Conference (GAC) is in the books, and what an experience it was! Every year, this event serves as a vibrant reminder of the incredible impact credit unions have in their communities. We left feeling inspired by your passion and unwavering commitment to serving your members while strengthening the financial ecosystems you’re a part of.

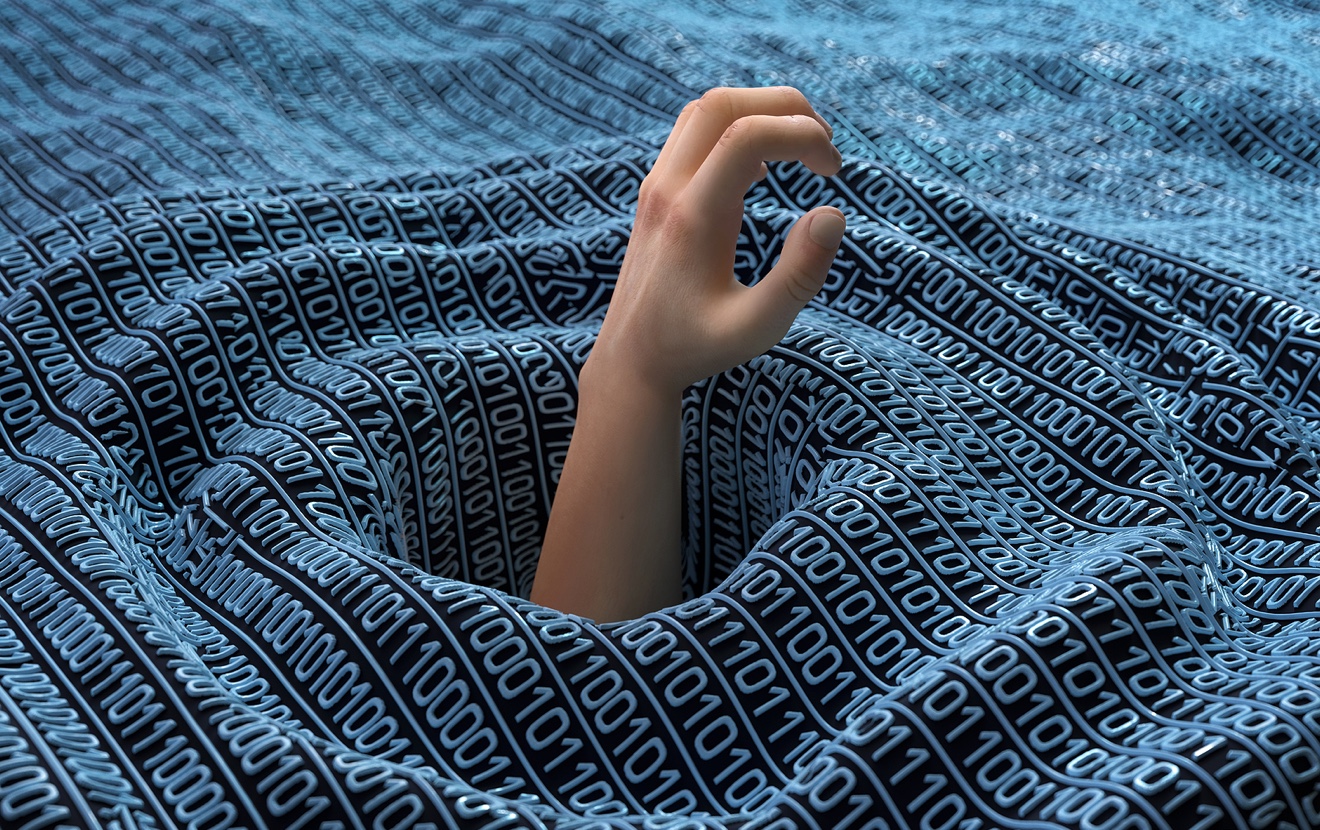

As we reflected on our time at this event, it was clear that financial services is at a pivotal crossroads, and the path forward is shaped by one key element—data. We hear data being talked about just about everywhere. But simply having data or claiming to use it isn’t enough. It’s about how you use it.

Understanding what problems you're solving, where to begin, and whether your current infrastructure can support these initiatives—or if it’s time to start planning for upgrades—is key to setting your credit union on the right course.

With that in mind, let’s start with several recurring themes that have been emerging in lending and deposits.

Megabank and fintech competition is a concern. More than half of executives consider these large financial players to be a significant threat, and for good reason. They’re using advanced technology and data analytics to not only attract your members but hold on to them with a firm grip.

Consumers are no longer satisfied with anything less than a fully digital experience. The bar has been raised, and mobile-first interactions are now the preference and the deciding factor when choosing a financial institution.

Instant decisions are the new standard. Whether applying for a loan or credit card or opening a deposit account, consumers now view real-time approvals and responses as a basic requirement.

Using AI and data is a competitive advantage. One of the reasons that megabanks and fintechs are successfully competing for your members is how effectively they use AI-driven insights and data analytics to improve decision-making, streamline processes, and enhance experiences.

Personalization is key to retention. Consumers aren’t shy about this expectation. They want financial institutions to tailor products, services, and marketing to their unique needs. Those who get personalization right are seeing stronger engagement and long-term loyalty.

Growth relies on more than one factor. From marketing and onboarding to application, decisioning, funding, fraud mitigation, and pricing—every piece plays a crucial role in driving success and delivering a better member experience.

How are credit unions responding?

We’re seeing more and more credit unions turn to data-driven and AI-powered solutions to meet member expectations and navigate an increasingly competitive market. While these technologies are not new, their adoption has accelerated due to the explosion of digital financial interactions, affordable data storage, and advancements in computing power. The sheer volume of available data has created opportunities for smarter, faster, and more efficient decision-making.

As a result, the market is now filled with a growing number of solution providers offering services that range from targeted marketing and data-driven credit decisioning to real-time portfolio monitoring and risk management. Credit unions that successfully integrate these innovations are better positioned to enhance member experiences, streamline operations, and maintain a competitive edge in an increasingly digital financial landscape.

While some financial institutions are thriving with new technologies, many are struggling to navigate the crowded landscape of data-driven and AI-powered solutions. In our discussions, we’ve identified several challenges that many institutions face when adopting these solutions:

- Institutions invest in one solution, only to find that a seemingly better option emerges every few months, making it difficult to stay ahead.

- With so many providers offering similar services, decision-makers struggle to determine which solution best fits their needs, often lacking clear selection criteria.

- Many solutions come with bold promises but fail to deliver when it comes to execution, leaving you with subpar results.

- While standalone solutions may work well, they often don’t integrate seamlessly with existing loan origination systems (LOS), core systems, or other banking platforms, leading to manual workarounds and increased operational complexity.

- There are numerous solutions tackling marketing, personalization, and automated decisioning, but without a unified strategy, you risk inefficiencies and missed opportunities.

To truly benefit from AI and data-driven decisioning, your credit union needs a well-integrated, scalable, and execution-focused solution that aligns with your infrastructure and long-term strategy.

What are the next steps your credit union should take?

Every credit union has its own unique challenges so there isn’t a one-size-fits-all approach. But no matter where you are on your journey, there are a few key ingredients that can help you shape a smarter, more effective data strategy:

- Digital transformation is a journey, not a destination. Continuous, incremental improvements are the key to long-term success. To maximize the impact of AI and data-driven solutions, you should take a strategic, step-by-step approach.

- Assess your digital maturity. Take stock of where you are now and define where you want to be. Understanding your starting point is critical to mapping out your digital progression path forward.

- Identify your biggest challenges and priorities. Is growing deposits your top goal? Are fraud concerns keeping you up at night? Struggling with low approval or booking rates? Pinpoint what’s holding you back.

- Ensure high-quality data fuels your AI solutions. AI is only as smart as the data it processes. Make sure you’re working with clean, structured, and relevant data—whether it’s from internal sources or external partners.

- Invest in a strong data infrastructure. Data is a powerful competitive advantage. Capture and analyze insights like decision turnaround times, processing efficiency, approval rates, and booking performance to make meaningful improvements.

- Align solutions with your goals. Choose technology that directly addresses your institution’s specific needs. Do your research. The best fit may not always be the flashiest or newest option on the market.

- Tap into your network. Engage with other credit unions and financial institutions that have successfully implemented similar solutions to learn from their experiences.

- Conduct a thorough ROI analysis. Your solution should actually be a solution, so make sure it delivers tangible value—whether that’s faster processes, automated decisions, higher approval rates, or stronger fraud prevention.

- Commit to a successful implementation. Even the best technology won’t deliver results without proper integration. Dedicate the right time, resources, and people to ensure a smooth, effective rollout.

The through line in all of this is data—and more importantly, using that data with purpose.

With the right strategy, infrastructure, and mindset, data stops being just a tool. It becomes the driving force behind sustainable growth, smarter decisions, and deeper, more meaningful member relationships.

The materials available in this article are for informational purposes only and not for the purpose of providing legal advice. You should contact your own advisors with questions regarding the content herein. The opinions expressed in this article are the opinions of the individual authors and may not reflect the opinions of MeridianLink, Inc.