We’re all aware of how tech is reshaping the way consumers do business with credit unions and other financial institutions; for instance, applying for loans entirely online or depositing payroll electronically, with funds made available to employees in cash or via debit cards. Most of these innovations were launched by traditional financial institutions and they’ve proven to be attractive because they provide the speed and convenience that many consumers not only want, but increasingly expect.

While these services are usually regarded as part of providing a positive customer experience, they also can serve as a barrier to building a long-term, personal relationship. As face-to-face interaction between customers and staff declines with the widespread use of ATMs and online services, members are likely to have fewer in-person meetings with their credit unions. However, even “virtual” customer interactions serve as opportunities to assure members that you know them, understand their needs and interests, and are willing to support them.

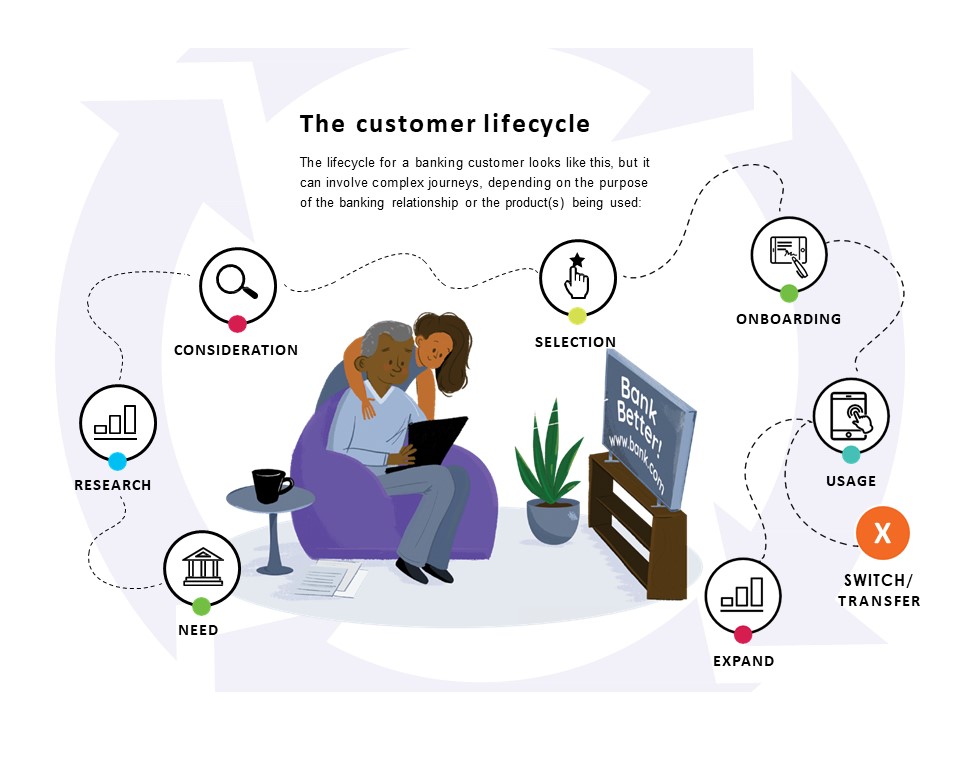

Banking organizations accumulate rich customer data that can be used to personalize communications to improve the customer experience and generate customer loyalty at every touchpoint, digital or in-person. For example, the need for account statements and business correspondence will always remain. With digital transformation, these documents are increasingly embedded in digital applications and become part of an overall customer experience. Many banks and credit unions also utilize them as part of a strategy to improve customer experience by adding relevant messaging, perhaps about mortgages for young married couples or the rewards available with credit accounts. At the very least, these communications should be a consistent representation of your institution in terms of tone of voice and the look and feel of the media vehicle.

As suggested above, as part of an overall customer experience strategy, specific communication content and messaging needs to be appropriate for each individual customer at each touchpoint, and this requires a sophisticated level of personalization. Messaging should encourage interaction and further engagement with emphasis on two-way communications versus outbound-only communications. Customer responses then become part of the customer’s history and can be analyzed and applied intelligently to future interactions.

It’s important for credit unions to recognize key opportunities to establish positive relationships with their customers, even as personal contact is decreasing. The following three “moments of truth” are important enough to impact a member’s decision to stay with your institution—or perhaps to start looking at your competitors—but they are by no means the only points of contact.

- Opening a new account

The process of opening an account for a new or existing member provides the credit union an opportunity to make a great—and hopefully positive—first impression. It signals to the member what he or she can expect in their ongoing relationship with the institution and is also an important opportunity to get to know your customer, their age, income, marital status, profession, etc. All of this information can be used to provide a customized and truly supportive experience for them throughout their relationship with your credit union.

This process can be simplified to allow members to open accounts online or via the mobile app—this is what most customers typically prefer, in any case—and then make digital onboarding documents available after they sign into your website with a secure login. If they wish to keep them, members can either print these documents or archive them on their devices. Many potential and existing customers will appreciate the time-saving convenience of self-service.

- Mortgage applications

In a commoditized mortgage market where customers are looking for the lowest interest rates and the lowest fees, a great customer experience is what differentiates your credit union from your competitors. However, the typical mortgage application process is a complex process, multi-page, confusing and loaded with legal language. Though securing a mortgage need not require a face-to-face meeting, customers do want to understand the process and the documents, preferably through consistent and personalized communication with the lender. Prompt notification of the status of their loans is also appreciated.

Because the mortgage application process must be personalized for the borrower, this represents yet another opportunity to gain deeper knowledge about your member’s interests and their current status in life and future plans. For example, is this a first mortgage to accommodate a growing family? Is it for a summer home? Or is the member a retiree and downsizing? In any case, the information gives some indication of more ways the credit union can provide further services.

- Financial difficulties

Perhaps nothing generates more anxiety in consumers than seeing more money leaving their accounts than coming in. This could be the result of overspending around holidays and special events, medical expenses, job loss or other financial difficulties. Regardless of the source, the outcome is likely to be an anxious customer and some form of debt. This gives the credit union an opportunity to ease the member’s fears and provide a less painful experience.

Using today’s technology, credit unions can monitor accounts in real time and use that capability to warn the member of an overdraft, perhaps offering an end-of-day or similar deadline for the member to make up the difference before being charged. It might also be worth considering if the member is facing a temporary furlough rather than being terminated from employment? If the member’s prospects are good over the long term—including ownership of valuable assets or other collateral—maybe extended credit would be in order. But you must know the member, both their history and future aspirations.

The payoff

While digital technology has made it possible for members to check a balance instantaneously, no matter where they are, and to pay for their purchases using their smartphones, banking institutions continue to play an important role in consumers’ lives. As such, credit unions need to do what they can to know who their customer is, understand their needs and show they are willing to work with them to achieve their financial goals. Providing a positive customer experience is an effective way to attract new clients, retain them over time and become their first choice for expanded products and services. A foundation of trust is a strong platform to build upon.