The commercial lending boom among credit unions continues to reach new heights. As of the end of the first quarter 2019, outstanding commercial loans at credit unions reached $73 billion, up 33% since 2015.

However, many are facing growing challenges in efficiently maintaining exposure to the stronger performers in their commercial portfolio. Lenders, of course, want to maintain their best client relationships. At the same time these borrowers will always want to lower their borrowing costs when their businesses grow and become more profitable. Given this behavior, credit union lenders are exposed to adverse selection problems whereby their best-performing clients seek to refinance early, and struggling loans remain on the balance sheet. Refinancing transactions also creates the risk of the credit union losing the lending relationship to another lender. In the banking industry, most financial institutions attempt to curb this risk by charging a prepayment penalty. However, federally-chartered and most state-chartered credit unions are prohibited from charging prepayment penalties. As a result, finding innovative ways to manage these risks will become even more important as exposure to increases throughout the credit union industry.

Proven mitigation strategies are available -- ones that avoid prepayment penalties and fees altogether. Yet, few if any credit unions leverage these tools today. One of the most interesting is a technique known as grid-based pricing, in which the borrower agrees to pay one of several applicable interest rates, based on a grid, that reflects the current risk of the loan at any given time. It’s a strategy that has been used by commercial lenders for decades. Here’s how it works.

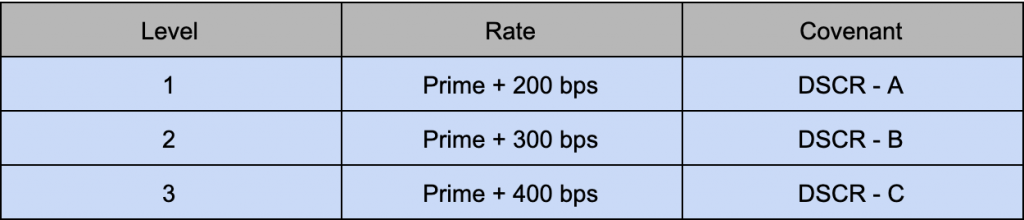

Consider a loan that pays interest at one of three different preset interest-rate levels:

When using grid-based pricing it is important to ensure that the rules for setting the interest rate are clearly defined and not ambiguous. Equally critical is for credit unions to use technology that facilitates grid-priced loans. That means being able to manage and track effective interest rate changes, receive rate-change notifications online, and issue invoices with the applicable interest rate without intense manual operations. In many cases, this may also mean looking for modern commercial lending tools that support more flexible loans than the traditional Cores. However, spending the time to find the right tool will be well worth it. Ultimately, it means more loans, more income, and more success with your commercial lending program. Whether the business pays interest at Level 1, 2, or 3 depends on its then-current financial performance. Credit unions can use various metrics to determine financial performance -- from common indicators, such as the Debt Service Coverage Ratio (DSCR) to more nuanced financial covenants, or perhaps even a combination of them. For instance, in the illustrative example above, if the DSCR improves, the loan’s interest rate resets to a lower rate. On the other hand, should the DSCR worsen, the interest rate would increase. By agreeing up-front to these different interest levels based on risk, a credit union is able to reset the interest rate, in real time, at a level that reflects the current risk of the loan and reduce the likelihood that they lose a high-performing borrower who elects to refinance their loans at a lower rate. At the same time, a credit union can ensure that if a commercial borrower underperforms, the credit union will be compensated with more interest due to the increased risk of the business loan. Grid-based pricing can be a win for the borrower, too. That’s because the borrower receives a rate that is competitive with their current performance -- not just their expected performance at closing. Ultimately, the net-effect is as if the commercial borrower efficiently executed a refinancing transaction without the time and expense of putting a new loan in place and the lender keeps a valued relationship without the risk of a competitive process.