Credit Union business lending is on the rise. Notably, as of Q3 2019, MBLs are 6.19% of total loans compared to 5.65% as of Q1 2018 according to NCUA. This growth is due to a few factors, not the least of which is a number of recent regulatory changes creating room for business lending growth to bloom, including:

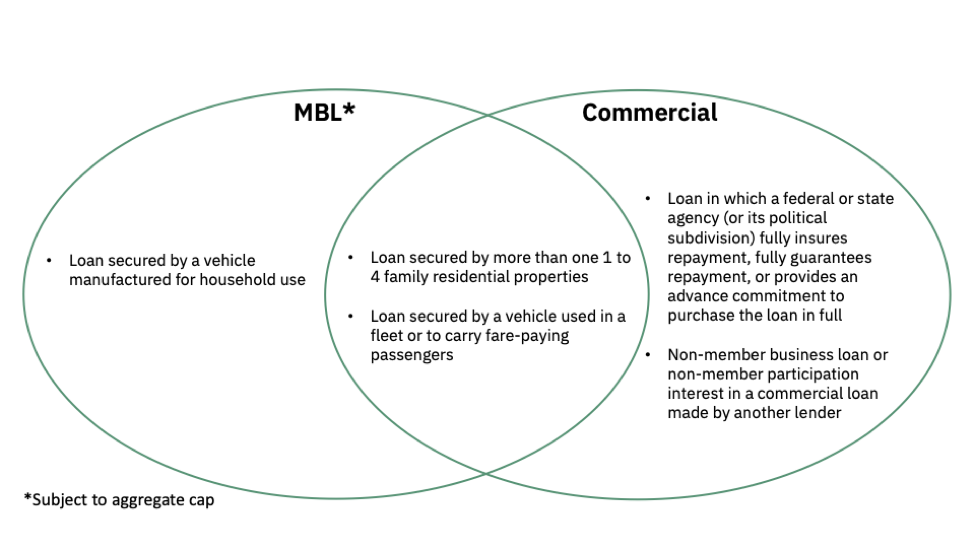

- A loan secured by a 1-to-4 family dwelling, regardless of the member’s occupancy status, is no longer classified as an MBL or commercial loan.

- A non-member business loan or a non-member participation interest in a commercial loan made by another lender is not classified as an MBL.

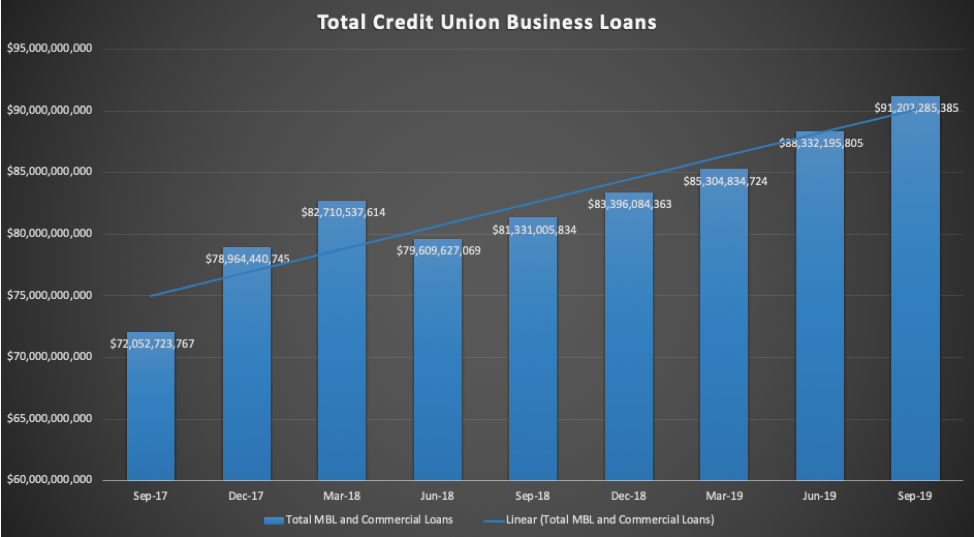

The data (in graph 1) shows that total business loans, inclusive of MBLs and commercial loans (accounting for the overlap between the two) have grown 27% over the last 2 years. Furthermore, as of Q3 2018, business lending has grown 15%, notwithstanding the removal of 1-to-4 family dwelling from the definition of MBLs. That growth doesn’t account for any single 1-to-4 family dwelling loans (which is likely growing as well) since those loans no longer count as business loans. So, in reality, if you consider 1-to-4 family loans in addition to business lending, the growth is even higher.

Beginning in June 2018, the data shows an initial drop in total MBL/Commercial lending, which reflects the removal of 1-to-4 family homes from those categories. In every consecutive quarter following, MBL/Commercial lending has continued to grow quarter over quarter.

Additionally, non-member commercial loans acquired through participations are not counted towards a credit union’s MBL limit, creating new balance sheet capacity for credit unions to better serve their business members while simultaneously diversifying their portfolios.

The terminology and classifications of MBL versus commercial loans is confusing, especially given all of the recent changes, so we’ve outlined the classifications that are considered MBLs/commercial loans/both to facilitate better understanding of the regulatory changes.

Ultimately, these regulatory changes and the resulting growth simply reflect the capital needs of small and medium-sized local businesses and how well credit unions can effectively match that need. Absent the combination of business need and credit union effectiveness, all the regulatory changes in the world would not have mattered.

While the future direction of the economy may be uncertain, what is certain is that credit unions will continue to grow business lending as the best provider of capital to this incredibly important but underserved area of business.