Payment methods are constantly evolving and to meet the expectation of consumers in today’s omni-commerce world, small businesses want to offer services such as mobile app payment processing and text-to-pay —but need a trusted provider to make it happen. What better partner than their credit union?

Research shows that small businesses overwhelmingly prefer to have all their banking and credit needs met by one financial institution. According to BlueVine, nearly nine out of 10 small businesses (87%) consider it important for a single provider to handle their credit and banking services. Additionally, a recent study by J.P. Morgan and Forbes shows that 52% of executives plan to consolidate their treasury and payment service providers.

Credit unions can assist businesses in meeting their goals by partnering with a reputable payments provider to offer merchant services. This partnership will increase member satisfaction, retention rates, competitive differentiation, and ultimately, level the playing field with larger regional and national financial institutions.

What Capabilities Local Businesses Want

Broadly speaking, merchant services enable businesses to accept and process electronic payment methods. The emergence of omnichannel commerce, where the payment process can happen online or offline, and the ability to accept payments virtually and in-person are now integral functions of a small business. Credit unions must recognize that offering small businesses a credit card terminal, competitive pricing, and timely deposits is no longer enough.

According to a recent survey by Paysafe, 52% of customers at 65% of businesses want more payment options. These can include methods beyond credit cards like cryptocurrencies (decentralized digital currencies), and digital wallets that store payment information and passwords.

Offering streamlined services is foundational in today's business ecosystem. When the small business owner views the credit union as a business partner, it creates strong, long-lasting consumer relationships. Companies that use their credit union for their merchant service needs will also bring in more revenue for the credit union. Elavon, a leading payments provider and financial institution merchant partner, shows an 88% increase in average revenue, an 85% increase in deposits, and an 80% increase in loans from businesses that use their financial institution for merchant services versus those with only a checking account.

Working with a third-party payments provider is an opportunity for credit unions to provide members with the type of all-in-one services they’re looking for. It can also be a tool to engage prospective members. For example, many payments providers now offer a broad range of services beyond traditional payment processing, including:

- inventory management;

- sophisticated payroll management;

- loyalty programs and

- integrated marketing.

According to one study, 53% of participants rank reliability as the top priority for American small- and medium-sized businesses (SMBs) when selecting a payment provider. Followed by:

- cost (47%);

- fraud management (29%) and

- and ease of integration (28%)

Types of Models and Evaluation Criteria

A credit union’s success in becoming an all-in-one financial solution for its members is directly tied to the performance of its merchant provider. The strengths and limitations of a potential partnership will positively, or negatively, impact the relationship between the credit union and its small business customers.

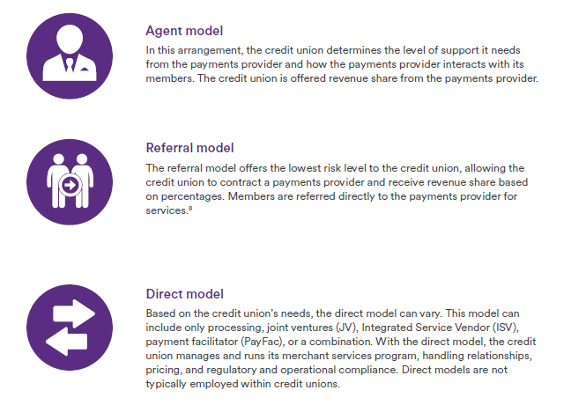

Merchant providers work with credit unions in a range of models. Each offers varying degrees of ownership, flexibility, and associated economics, but all are focused on strengthening the value of a credit union’s services.

When exploring potential merchant services providers, credit unions should consider the following as guideposts for determining the viability of a payments provider.

- Financial considerations

- Cash flow and currency

- Vertical support

- Operational efficiency

- Risk management and compliance

- Support structure

Download the full whitepaper for further details supporting each guidepost and to view all sources. No matter the model, a strong partner gives small business owners ways to increase revenue, process orders, and manage inventory while meeting consumer expectations securely and risk-free.

If your credit union is exploring how to expand your offerings through payment process and merchant services, we encourage you to read more here or reach out with any questions.