$27.5 million, and 70%.

The former is the average cost of a digital transformation project, according to the International Data Corporation's Worldwide Digital Transformation Spending Guide.

The latter is the percentage of digital deployments which, according to McKinsey, fail or fall short.

Those aren't great odds, for any organization, including large international banks with deep budgets. But when you're an organization with limited resources, such as a regional bank or a credit union, it can become a chicken and egg situation.

On the one hand, a better digital experience is increasingly one of the primary reasons Americans switch banks.

On the other hand, the dearth of widely available, easily accessible digital banking best practices means product managers and UX teams must spend huge amounts of time and energy trying to figure out the basics via trial and error. And if you have limited resources and budget to work with, the poor odds may not make it feasible.

This is exactly the problem one of our clients faced before they signed up to our digital banking research platform FinTech Insights.

Here's a rundown of how our platform helped them:

- De-risk their digital strategy by replacing trial and error with data-driven decision-making

- Plan the roadmap for their MVP—minimum viable product—accurately and efficiently

- Shorten their go-to-market time by 60%

The client, a credit union with $3 billion in assets headquartered in Texas and with a presence on the west coast, acquired a digital banking vendor in order to have the in-house capabilities to build a new digital banking platform from scratch. This would replace the app they had at the time, which had a two-star rating and was the subject of thousands of customer complaints.

Without access to recent market data, it was difficult to figure out what the minimum viable product should look like to be up to par with that of its competitors. In particular, the credit union faced the following challenges:

- Understanding which digital banking features they were lacking compared to other banks and credit unions in their market

- Working out which features to prioritize in order to achieve the most impact with its limited resources

- Deploying their MVP as quickly as possible, while minimizing the risk of it being outdated or having a poor user experience on launch

Enter FinTech Insights, which helped the credit union overcome these challenges, without going through a lengthy (and costly) trial and error phase.

The single biggest reason for the credit union's challenges was a lack of visibility into the current state of their market.

Without knowledge of their competitors' strengths and weaknesses—or even of what the standard of digital banking is like in their market—the credit union had to rely on educated guesses. This is always a risky strategy, but especially so given the credit union's limited resources, and with statistics putting the failure rate at 70%.

Using FinTech Insights eliminated the guesswork, enabling the credit union to make development decisions based on accurate, up-to-date data.

First things first, the credit union created a market of focus: a list of firms that operate in the same markets it operates in, and which it considers to be its competitors.

Our client's market of focus consisted of 30 firms. It included:

- 10 national banks, such as Bank of America, Capital One, and Charles Schwab

- 4 regional banks, such as First Horizon Bank

- 8 credit unions, such as Baxter CU, Golden 1 CU, and PenFed CU

- 8 challenger banks, such as Ally, Chime, and Stash

Once the credit union defined its market of focus, the next step was to evaluate the digital features available, and how these compared to its own offering.

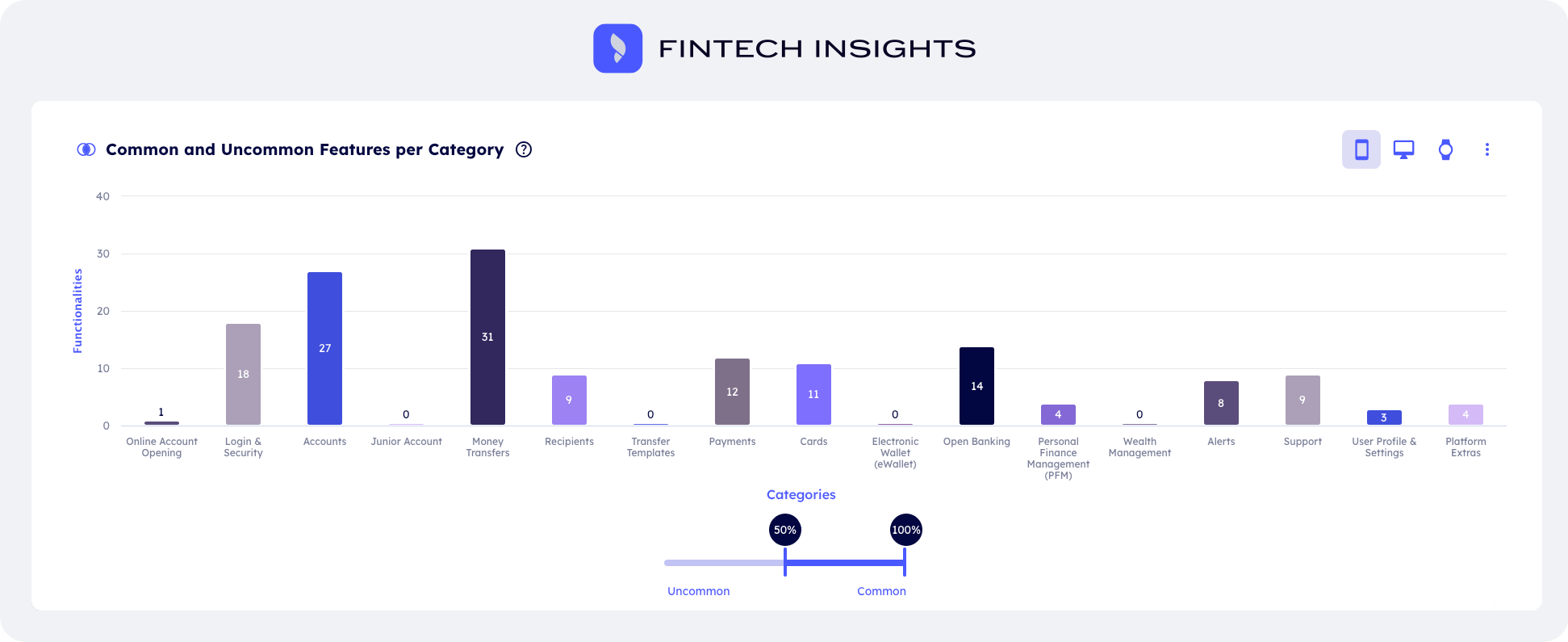

To do this, the client used FinTech Insights' Common / Uncommon Features Per Category graph. This FinTech Insights feature has a filter that enables you to fine-tune the results. As the client's ultimate goal was to build an MVP, they set the filter at 50% to 100%, so that it showed them the digital features offered by at least half the firms in their market of focus.

The client sorted the results by "Most implemented" so as to see which features were absolute must-haves.

With this data at hand, the credit union was able to work out what to prioritize, starting with the features its digital platform needed to have in order to be at least of the same standard as those of its competitors.

Step 3: Designing an intuitive, frictionless UX

Understanding which features your digital platform lacks, in order of priority, is half the battle.

But nailing down the implementation is just as critical. And it's often where firms lose time and fall short, again because a lack of visibility into how competitors have overcome design and UX challenges forces them to work this out using trial and error.

With FinTech Insights, the client was able to view step-by-step video walkthroughs of how their various competitors implemented the same functionality.

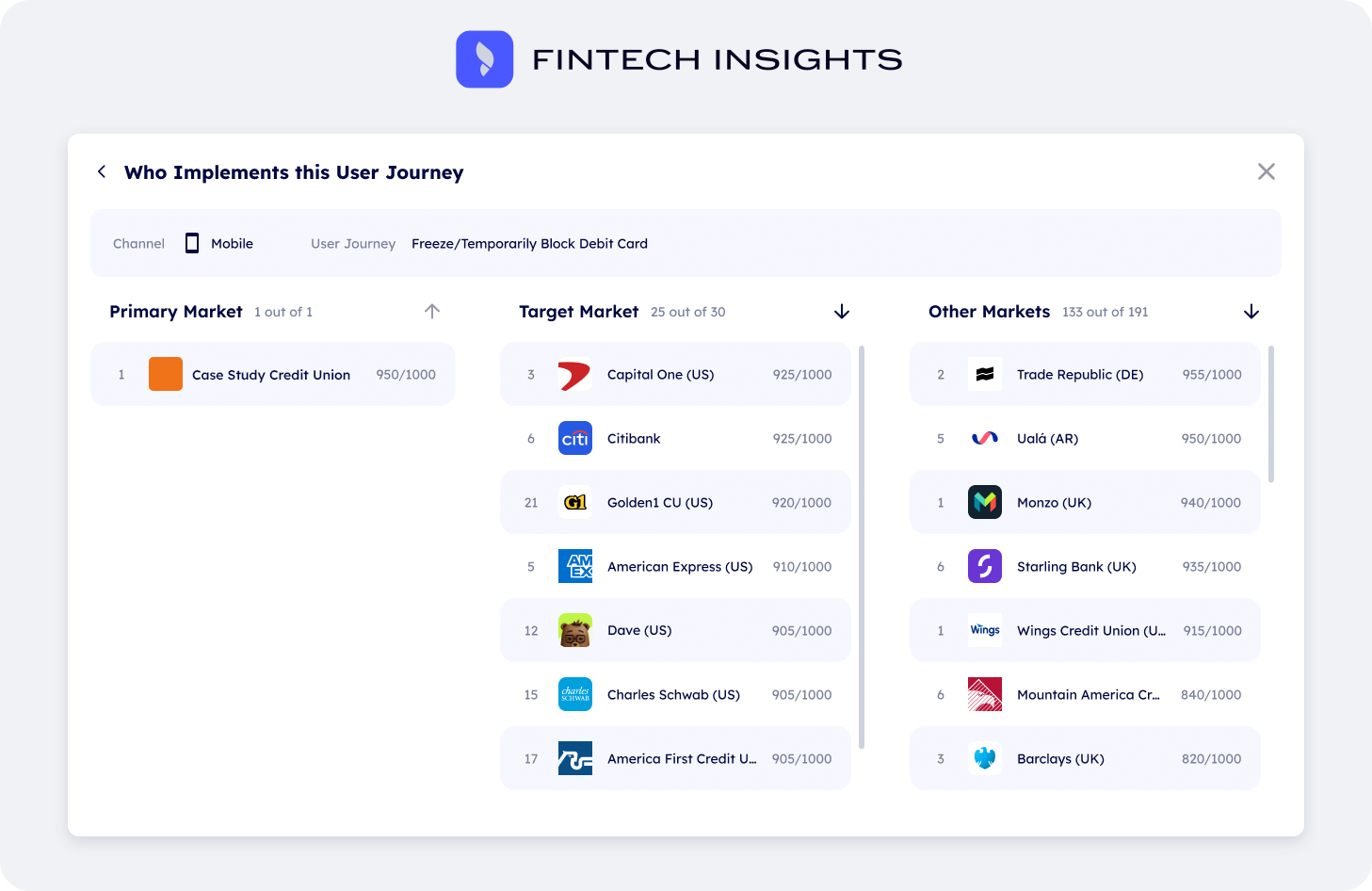

Case in point, once it identified 'Block Card' functionality—the ability to temporarily freeze or block a debit card—as one of the top most commonly implemented user journeys, it could see exactly how each competitor implemented it.

The credit union could also evaluate which implementations were the most user-friendly by using our proprietary Perfect 1000 scoring system, which quantifies how much effort a user journey entails, both in their market of focus, and in other markets they might not have considered.

Having sorted the various implementations by Best UX, the credit union could then use the video walkthroughs for inspiration, studying the technicalities and using this knowledge to speed up development instead of having to work out how to build Block Card functionality (and other features) from scratch.

Consumers have been expecting banks to be at least as good at digital as tech firms like Amazon and Google for a long time. But, more and more, they're also expected to be cutting edge, with 47% of respondents in an MX survey saying their bank should do more to be innovative.

While there's no getting around these expectations, innovation doesn't mean reinventing the wheel. It means taking what's there and improving on it, making the user experience better in unexpected ways.

With FinTech Insights our credit union client gained visibility into what's being done in their market, right now, who does it best, and how they do it. This enabled them to:

- Slash user-journey planning and design time, from the three weeks per user journey they initially projected, to one week per user journey

- Build a strong business case, and prove that their proposed implementations would be compliant

- Avoid the trial and error phase completely, reducing the risk of failure and delivering user-friendly, secure, and compliant user-journeys 60% faster

- Gain a 4.8-star app rating, with more than 17,000 customer ratings to date.

Struggling with poor visibility, a small team, and a limited budget?

Let's show you how FinTech Insights can help you ditch these constraints and compete with industry giants.