To say that 2020 has been a year of upheaval is certainly an understatement. From mandatory shutdowns, supply chain disruptions and travel restrictions, businesses across a broad swath of industries have been ravaged by COVID-19 and its economic effects. Many small businesses are facing a critical cash flow crisis, putting pressure on credit unions’ balance sheets.

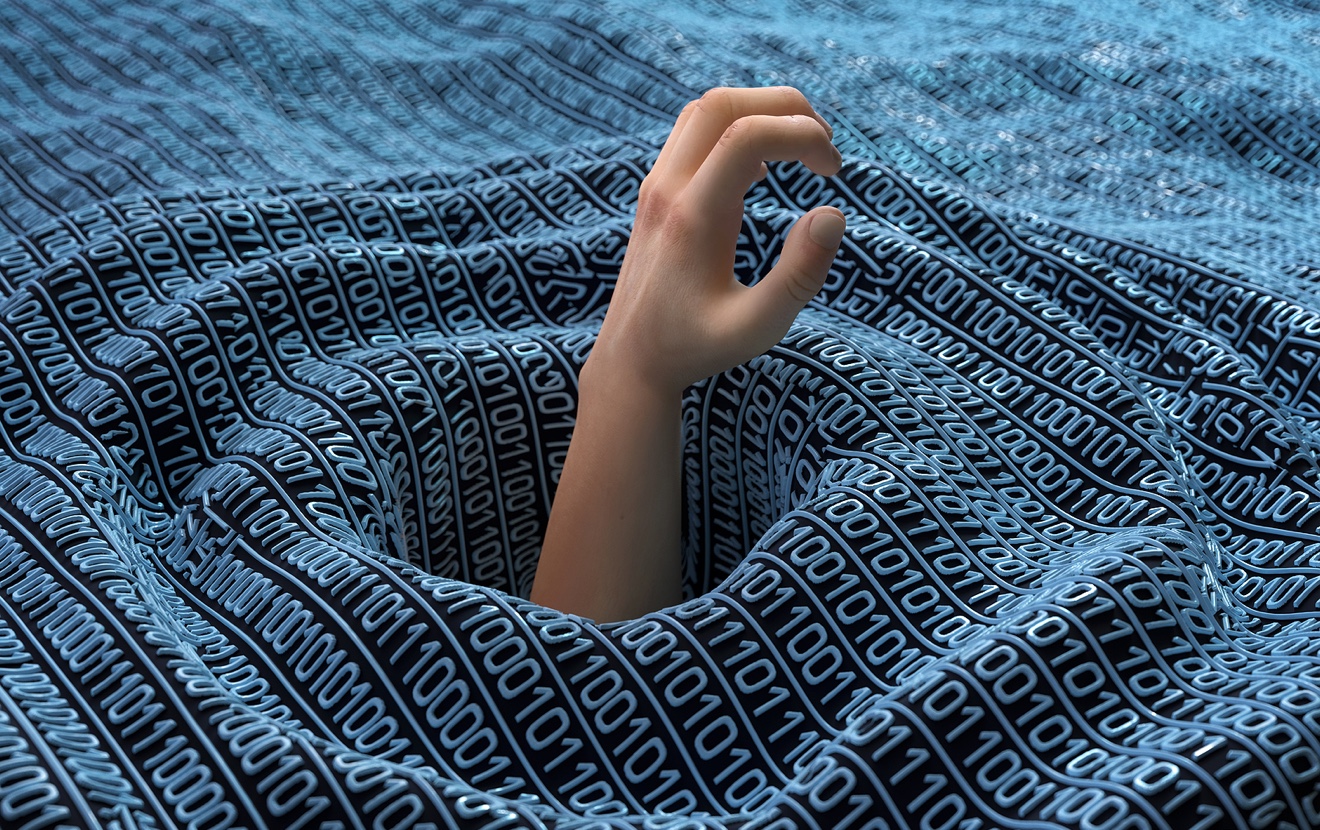

Is your institution prepared to anticipate potential defaults and proactively respond to non-performing loans? The key lies in aggregating and unleashing the power of the data you already have at your disposal to identify behavioral changes in your members and mitigate rising credit risks and delinquencies.

Business Failures Anticipate Rising Defaults

According to the Wall Street Journal, business bankruptcy filings in the US were up 43% year-over-year in June . Moreover, 7% of mortgages are in forbearance, and serious mortgage delinquencies are on the rise – 2.3 million properties not in foreclosure were 90 or more days past due in September. In fact, the number of U.S. mortgage loans 30 days or more past due is up 89% year over year .

The IMF estimated that total debt at-risk worldwide could reach $19 trillion, or even higher, with cost of risk losses expected to top out at 2.0 – 2.4% in 2021, well above the peak at the height of the 2008 global financial crisis. As credit unions face a coming wave of problem loans, many are minimally prepared to manage the surge.

Financial institutions are facing a number of structural hurdles that may inhibit their ability to identify or report on rising risks in their commercial, consumer and residential loan portfolios. These include a reliance on time-consuming, manual processes, and inconsistent, siloed operational processes scattered across aging legacy systems and non-integrated point solutions.

Many credit unions still use Excel reports to track loan performance and portfolio risk metrics, an unreliable and inefficient method rife with data entry errors and duplication. It’s no wonder many lenders struggle to ensure vital information doesn’t fall through the cracks.

At the same time, loan officers and relationship managers have little meaningful access to the credit union’s vast troves of member and transaction data, reducing their ability to understand and serve their borrowers’ needs. Also, with many institutions still working remotely to some extent, this hurdle becomes even more troublesome.

Lastly, as regulatory guidance evolves quickly during a potential credit crisis and examiners take a more proactive approach to monitoring their institutions’ safety and soundness, financial institutions may struggle to stay up on the latest compliance changes and examiner guidance.

A Data-Driven Approach to Problem Loan Management

Lending is a business of risk — if you make loans, you must be prepared to absorb some losses. However, success comes to those credit unions that are adept at mitigating known risks and minimizing surprises. To be effective, you must closely monitor the health of your borrowers and anticipate worrisome trends, before they arise.

To address the challenge of managing problem loans in an environment of potential rising delinquency, business failures and softening collateral values, financial institutions must pull out all the stops. According to Accenture, innovative credit programs focus on these four key areas ahead of a down credit cycle:

- Proactive, intelligent portfolio management and credit monitoring;

- Ramping up collection and risk management capabilities for the upcoming surge;

- Activating data-driven insights to predict member needs and behaviors; and

- Empowering front-line personnel with automated, digital capabilities to provide optimized, customized solutions.

Institutions that take a proactive, data-driven approach are able to measure performance in specific industry and geographic sectors, predict probabilities of default and offer tailored solutions to those borrowers that need it most.

Being There for the Long Run

As delinquencies rise and credit risk increases in the next few years, credit unions will need to balance a number of priorities. These include having a clear-eyed view of regulatory direction and areas of focus, strengthening collections and credit monitoring staff and resources, and proactively managing risk in the portfolio while also acting as trusted partners with their valued borrower relationships.

All of the above will require a reexamination of how financial institutions identify, manage and monitor problem loans, and the implementation of cost-effective, data-driven solutions to credit recovery. Credit unions must look beyond traditional sources of member data, and embrace new, unorthodox approaches that consider environmental, macroeconomic, geographic, behavioral and industry-specific information, along with “contextual analytics” which examine everything from retail foot traffic to online shopping and credit card spending trends.

This new approach will also leverage automation and back office efficiencies to reduce operational expense, minimize errors, increase reporting transparency and speed up access to real-time data patterns. Based on Accenture research, the use of AI and automation capabilities in the back office can reduce collection expense by 25 to 40%.

Financial institutions are facing a potential tsunami of problem loans that hasn’t been seen in at least a decade—perhaps much longer. Fortunately, they also have access to a larger volume and wider range of relevant data than ever before. By transforming the credit management organization to a fully digital enterprise powered by data, analytics and automation, lenders will be well-positioned to ride out the coming credit crisis by efficiently managing the problem loans in their portfolio and serving their members and communities with integrity and empathy.