Cooperativas, SACCOs, credit unions and financial cooperatives may have different names around the world—but our DNA shines through collaborative initiatives like World Council of Credit Unions’ Global Classroom.

This unique platform for professional exchange brings together dedicated professionals from around the world through a variety of face-to-face learning opportunities designed to highlight impactful strategies for improving cooperative financial services.

For two weeks in December 2018, our collaborative DNA was on full display as the Global Classroom traveled coast to coast in the United States and explored how the digital transformation of credit unions is improving financial services for members. Credit union organizations inSouthern Californiahosted a diverse delegation from Ecuador, Guatemala and Peru. In the D.C. metro area, a delegation of executives and directors from Savings and Credit Cooperative Organizations—or SACCOs, as credit unions in Kenya are known—braved the first gusts of winter to see how financial cooperatives are emphasizing a personalized approach to connecting with members across all service channels. Those gatherings provided insights on the realities facing credit unions in those nations.

- Theaverage salaryfor secondary schoolteachers in Kenyais$300-500/month.

- Credit unions in Ecuadorare subject to the sameincome taxesthat for-profit businesses pay.

- InGuatemala, credit unions have come together under the MiCoopebrandin a nationalnetwork, sharing back office services and a core banking platform.

- Thethree largest credit unions in Peruwere established to serve the community of Peruvians ofJapanese descent

That’s a lot to unpack—credit unions addressing income disparity, defending the cooperative model for financial services, increasing awareness through collaborative initiatives and finding strength through a focus on community.

After the visits, our hosts often ask what the visiting delegation found most surprising about credit unions in the United States. They repeatedly are struck by one thing in particular—collaboration. From chapter meetings to shared branching, credit unions in the United States recognize the value in collaboration and gain strength from it. We see it in the diversity of CUSOs improving access to services and improving the sustainability of credit unions, big and small. Working together, we are stronger.

In 2019, the Global Classroom will continue to explore strategies for collaboration to assist financial cooperatives with the process of digitization. As we look forward to another year of travel and exchange, I hope you will consider making your mark and being marked by connecting with your peers around the world through the Global Classroom.

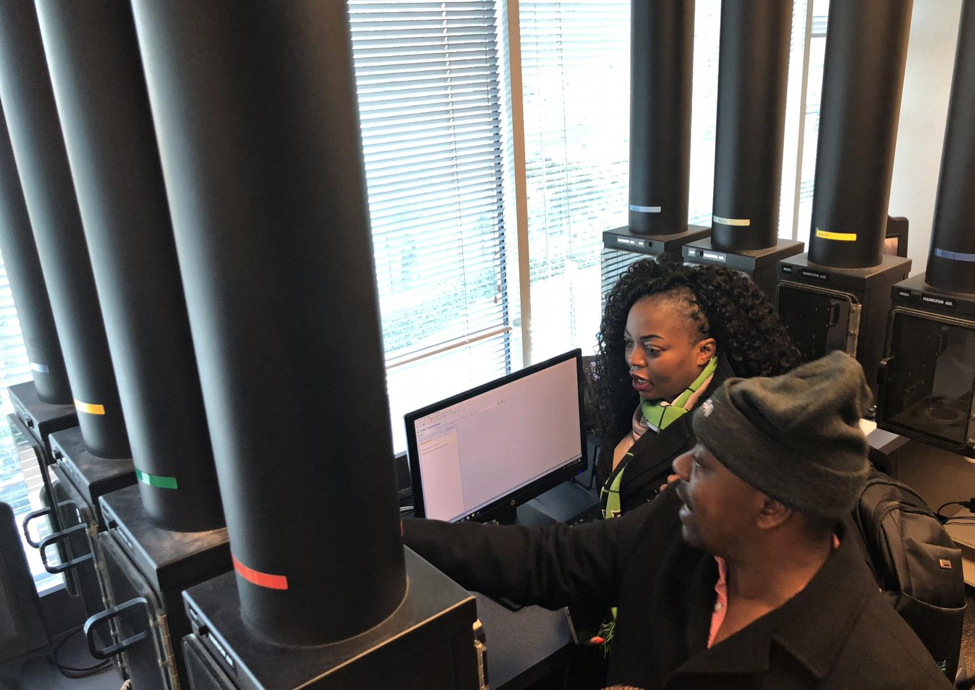

Fairfax Federal Credit Union becomes a center for learning in the Global Classroom.

Schools First CEO Bill Cheney shares insights on personalized service during our round table.

Drive-thru banking technology is always of great interest to international visitors in the Global Classroom