Advancements in technology and socioeconomic conditions have positioned credit unions at a critical juncture as they navigate a new generational shift: millennials, currently aged 28 to 44, are said to be on the cusp of inheriting the lion's share of the world’s wealth. Millennials, who stand out due to their reliance on technology and distinct financial challenges, are a key generation for credit unions. By aiming to innovate their digital offerings and product portfolios, regional and community financial institutions (RCFIs) can build solid relationships with this group just in time for the largest intergenerational wealth transfer in history.

A recent national generational study conducted by Alkami involved 1500 participants who are active digital banking users at either banks or credit unions, and weighted to the 2020 US Census for age, gender, region, and ethnicity. The study explored various trends, beliefs, behaviors, and preferences of millennials, particularly in a rising interest rate environment, highlighting opportunities for RCFIs.

Digital banking: The gateway to millennials

The study reveals that for millennials, outstanding digital banking solutions and experience are demanded. They expect digital channels that combine sales and service effectively. To stand out, credit unions must utilize data and artificial intelligence (AI) to provide personalized offers, so leaders in the institutions evolve into data-informed digital bankers.

“For millennials, the price of entry is an exemplary digital banking experience, where the digital banking channel is equal parts sales and service.” - CMO of Alkami, Allison Cerra

Millennials have faced significant financial challenges, shaping their financial behaviors and decisions. From the impacts of the Great Recession to the disruptions caused by COVID-19, this generation has dealt with instability and a changing job market. As they enter their peak earning years, their experiences have led to specific digital banking preferences and product needs.

Economic pressures

- Interest rate sensitivity: A significant 73% of millennials report that rising interest rates have impacted their standard of living, more so than Generation X and baby boomers. Additionally, 65% of millennials feel they are living paycheck to paycheck.

- Homeownership views: Over a quarter of millennials see homeownership as a financial burden rather than an asset, marking a shift in traditional wealth-building perspectives.

Digital banking experience

Millennials prioritize a seamless digital banking experience that integrates sales and service. The study found that 61% of millennials value the digital banking experience highly, and 46% define their primary financial institution (PFI) as the one where they do most of their online or mobile banking. They are also more likely than older generations to switch providers for a better digital experience (58%).

48% of millennials have been so frustrated trying to complete a digital banking task that they just gave up.

Personalization

Millennials appreciate personalized financial services powered by data analytics and AI, which align with their individual needs and goals. RCFIs that leverage data to provide tailored services are more likely to attract and retain millennials.

Millennials not only want, but deeply value relevant product recommendations to help them manage their finances.

Strategies for credit unions

Credit unions have a unique opportunity to appeal to millennials who want that one-to-one personal experience. Honing in on their preferences and a strong digital presence are key. RCFI’s should focus on:

- Enhancing digital tools: Investing in technology to improve the digital banking experience, making it intuitive, efficient, and secure.

- Developing competitive products: Offering attractive deposit and loan products that are easy to access online.

- Utilizing data: Becoming data-informed to provide personalized advice and recommendations.

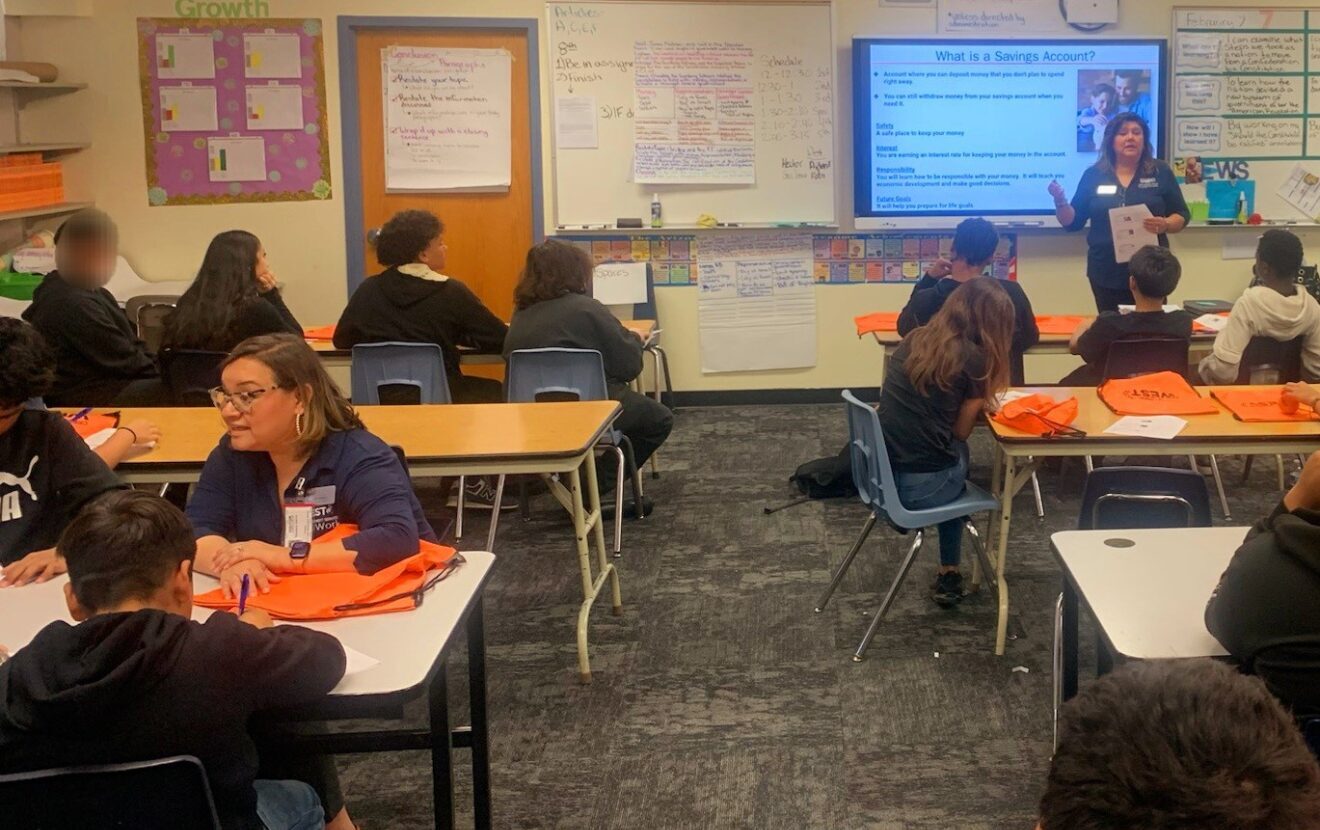

- Building financial education: Providing resources to help millennials manage their finances, fostering trust and loyalty.

- Assessing digital maturity: Using tools like the Digital Sales & Service Maturity Model Research Report and the Assessment to evaluate and enhance digital capabilities.

Data-driven strategies can help credit unions build ecosystems that support millennials' future financial needs and asset growth. As millennials navigate their financial journeys, credit unions are well-positioned to meet their unique needs, setting the stage for future growth and success.

This study provides business-critical research insights to financial institution leaders at an important moment of generational transition.

Download the Generational Trends study.

Assess your credit union’s level of digital maturity.