In their Q2 report, Historically Low Delinquency Rates Coming to an End, economists at the Federal Reserve Bank of New York made the following observations about the economy that point to delinquency storm clouds brewing for many credit unions and their members:

- Total household debt increased by $312 billion during Q2 2022.

- Consumer debt balances are now more than $2 trillion higher than they were in 2019.

- All debt types saw sizable increases, with the exception of student loans.

- Mortgage balances have climbed $207billion since Q1 2022.

- Credit card balances saw a $46 billion increase since Q1.

- Auto loan balances rose by $33 billion in Q2.

In recent months, borrowing has increased significantly across the board due to inflationary pressure on just about everything from homes and vehicles to fuel and groceries.

According to the report cited above, “In part, the growth in each debt type reflects increased borrowing due to higher prices. Prices for both homes and motor vehicles have been rising, and the borrowing amounts have risen in tandem—in fact, the average dollar amount for new purchase originations ofbothautos and homes is up 36% since 2019. Purchase mortgage origination volume is up 7% in the second quarter, driven primarily by increased borrowing amounts … Increases in car prices are also pushing up auto loan origination volumes.”

As Consumer Balance Sheets Deteriorate, Delinquencies Are Starting to Rise

In hisQ3 Economic Outlook for Financial Institutions, SWBC’s Chief Economist,Blake Hastings, provided the following insights on rising consumer credit and deteriorating borrower balance sheets:

Consumer balance sheets are still relatively healthy, today, thanks in large part to the rounds of stimulus during the pandemic. Those savings have been spent andcredit card usage has risen an astonishing 13% quarter-over-quarter.

This indicates that with high gas and food prices, consumers are turning to their credit cards to make ends meet. Thisdeterioration in consumer balance sheets will continue as long as inflation outpaces wages.

Some borrowers are already beginning to fall behind on payments. According to the New York Fed, delinquency transition rates for credit cards and auto loans are creeping up, particularly in lower-income areas.

Credit Unions in Southern States Are Being Hit Hardest by Rising Delinquencies

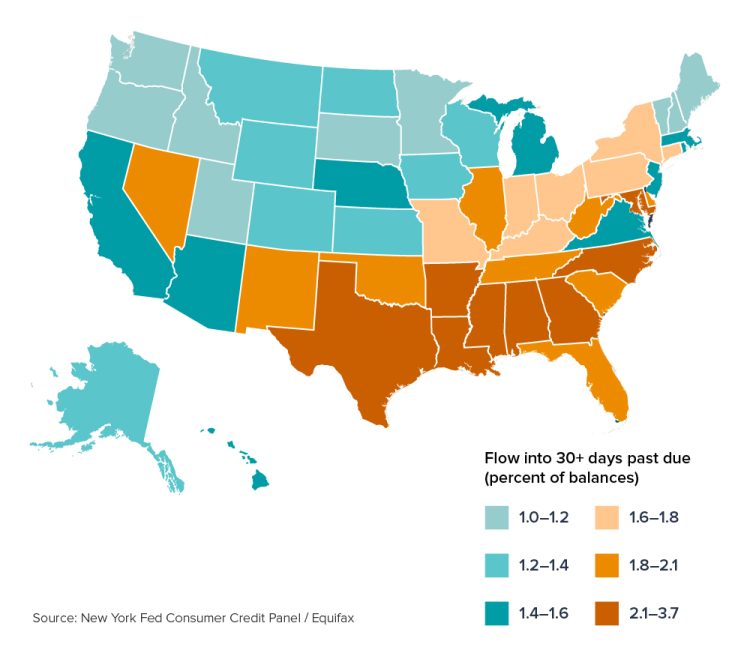

As you can see in the map below, the share of auto loan balances 30+ days past due is heavily concentrated in southern states, reflecting varying borrower demographic makeup and economic conditions in these areas.

The New York Fed notes that a map of the delinquency transition rates from Q4 2019 would yield a nearly identical picture; the rankings of the states in this map are hardly changed from their ranks before the pandemic.

Steps Your Credit Union Can Take to Prepare for Rising Delinquencies

Thanks in part to pandemic-era relief packages insulating savings accounts in 2020 and 2021, the overall credit health of many Americans remains relatively resilient.

However, the recent rise in delinquencies suggest a pattern that points to some communities or individuals experiencing harsher economic realities. These patterns may be hinting at the return of pre-pandemic delinquency patterns.

Having an innovative collections communication strategy is a critical aspect of staying relevant, engaging, and providing value to your borrowers.

By orchestrating a suite of omnichannel communications for collections, including text, email, and interactive voice response (IVR) systems, credit unions can be better prepared to communicate effectively with members. Taking an omnichannel communication approach also allows collections departments to scale much faster.

In the face of rising interest rates and delinquencies, leveragingoutsourced collection servicescan be an efficient, cost-effective option to minimize your collections queues and the time employees dedicate to the collections process. SWBC’s omnichannel collections communication strategy allows you to meet borrowers on their preferred channel, substantially improving their member experience.

To learn more about how your credit union can prepare for rising delinquencies, check out our latest white paper, Modernizing Your Collections Operation. Download your free copy, today!