I had the privilege to sit down with two industry leading CEOs and an AWS Enterprise Strategist last week at ourCUInsightCloud Champions CEO event. The conversationraised somepowerfulnew insightsfrom credit union leaders.

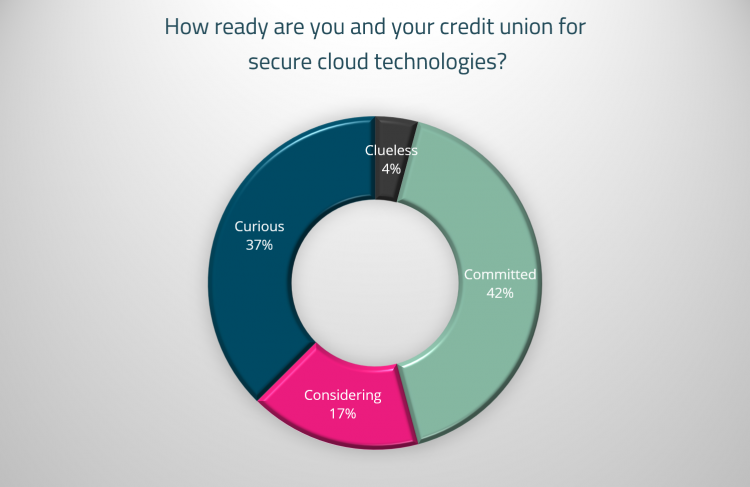

Driven by fintech competition and thechallenges of COVID-19, the credit union industry is seeing a trend among executiveswho arebecoming lesscurious andmorecommitted to exploring the adoption of secure cloud technologies.There is ashift towardsagile cloud adoption especially as executivesdiscover the cost benefits through a reduction in maintenance expenses anda faster time to market for new applications and services for members.

Ascyber attacksand ransomware become daily events, and members demand more digital banking experiences, credit unions can no longer afford tofocusresources onsustaininglegacy infrastructure and the expense to build and maintainon-premise datacenters.There is greater recognition that the risks associated with not being in the cloud far outweigh the risks of beingin the cloud.

What are some common challengesamong credit unions that are driving a cloud-first strategy?

- Infrastructure is at the end of its life and needsreplacing

- Noaccurate inventory and monitoring of technologies and serversin use

- Budget prohibitive to hireinternal talent to effectivelybuild, manage and maintain infrastructure andever-changing securitychallenges

- Increased need forresiliencyand secureDisaster Recovery(DR)platforms

What are some of thebenefits credit unions experience with a cloud-first strategy?

- InternalITteamscan nowfocus onmaking their core applicationsmore efficient and effectiveformembers

- Decrease in time to market–the cloud provides the opportunity to build new infrastructure for new applications and products inastounding time reductions such as72 hours versus 3-6months

- Agility to adapt as needed includingrapidlytransitioning toremote worksecurelywithout major operationalissues

The credit union industry has been slow toadopt a cloud strategy due mainly to analysis paralysis. Fortunately, there are enoughsuccessfulcase studiesfrom every industry and other banks and credit unions have paved the way, creating best practices for digital transformation to asecure cloud strategy.

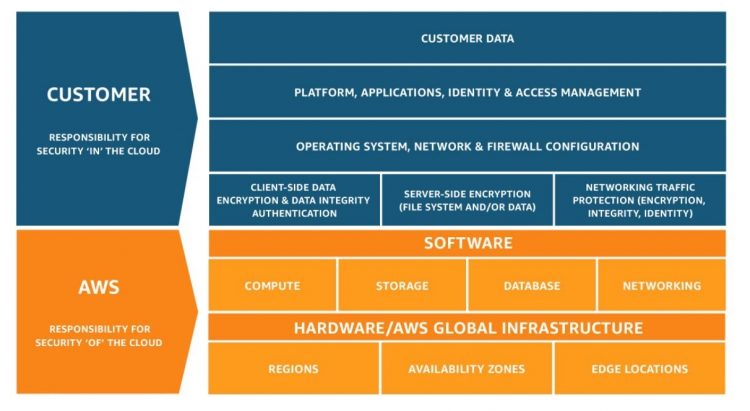

Partners whoarefamiliar withtheshared security modelas well as the credit union industry – whataretheregulations, what are examiners looking for, what questionsare they asking – can help educateboard members and ultimately ensure their buy-in.When credit unions embrace innovation and minimize the cost of failure, theyallowforexperimentation and iteration to develop solutions to business challenges.

Threats are occurring and changing everyday. Legacy equipment drives vulnerability, requiring tremendous resources internally. With the cloud and external partners, credit unions with a cloud-first strategy have instant access to accurate information about servers and data.The cloud allows credit unions to respond quickly and securely to cybersecurity breaches or natural disasters.

With any great innovation also comes great responsibility,and during andaftercloud migration credit unions must remain acutely focused on their role as secure custodians of member data. Like any technology,the cloud is a tool and credit unions need to understand where their responsibilities start and end.

The cloud will deliver powerful computing resources, storage, data bases and networking along with hosting locations,DRpossibilities and a huge selection of tools and services. Thecredit unionis ultimately responsible for everything else and needs to make sure their teams and vendor partners clearly understand their role and risk exposure so they can secure all aspects of their operations.

A cloud-first strategy can be extremely cost-effective with some organizationsreducing infrastructure ownership expenses 30-50%. The cloud offers an economy of scale with providers like AWSsharing the burden to assist with security and compliance,andmonitoring for new opportunities, which allowsinternal credit union IT teams tofocus efforts on building new applications and developing new vendor partnershipsfor whichthey previouslydidn’thave the time or budget.

A cloud-first strategynot only allows an organization to scale upto take advantage of new technologies, but also to quickly scale down.If a situation like the COVID-19 pandemic affectsan organization’s budget, they can easily scale backtodecrease costsbyturningoffserversordecommissioning test and dev environments.

More and more credit unions are realizing the benefits of a secure cloud strategy:

- Improved collaboration

- More secure remote work capabilities

- Transform internal team focus from infrastructure to building new applications and bringing on newpartners

- Ability to jump into new opportunitiessooner

- Flexibility toinnovate without massive investment into physical infrastructure that can’t be easilyeliminated

- Confidence to address future uncertainties whether it’sdelivering a new digital experience or responding to a globalpandemic

- Reduce threatlandscape