It was not that long ago when the motivation for building a credit union branch location was to reach out to areas that were underserved by other financial institutions and bring the credit union philosophy of “Serving the Underserved” to people in need. My hope is that this will always be the main motivation for location expansion, but as time goes by things have evolved. It was not that long ago that the headquarter location generated enough net income to pay for not only the cost of expansion but also the short- and long-term sustainability of any new location. This over time has proven to no longer be the case. Credit union branches need to be able to stand on their own and ultimately generate positive net income.

A branch is a business within a business, and the Branch Manager is the CEO of the branch, the motivator, the strategic planner, the trainer, the person who knows and understands the numbers and ultimately is responsible for the performance of the branch financially. The majority of branch managers I have met across the country are individuals who have risen up through the ranks. The question we have to ask ourselves is, what have we done to ensure that the person we have put in charge of the branch will succeed?

Can your managers answer these questions:

- What is the percentage of the branch's business to the total credit union? If the credit unions total assets are $100 million and the branch is 30% of the total, then that manager is running a $30 million dollar business within a business. Bigger picture, do they know the financials of the credit union and their branch numbers.

- Who are the top performers in the branch from a dollar perspective. Member surveys are very important and are great motivators but knowing how an employee contributes to the bottom line is very empowering as well.

- Do they understand the concept of an entrepreneurial culture?

- What is the ongoing training and career development plan in the branch?

- How do we attract, retain and reward our employees?

- How do we maximize technology and still be true to who we are as a credit union?

- Has a sustainable member-focused educational sales culture been implemented?

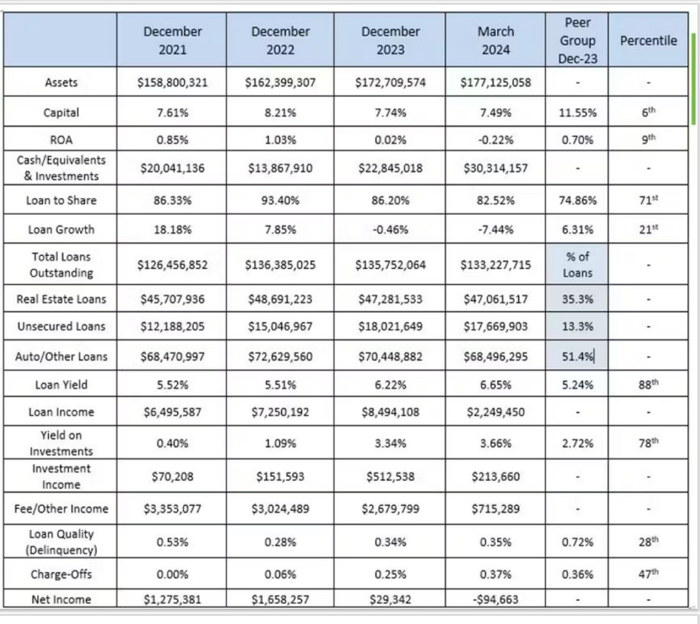

Let’s address the first bullet point—knowing the numbers. One of the key elements of being successful in business is actually a very simple concept—KNOW YOUR BUSINESS. In our business, numbers are part of our everyday culture. A credit score is a 3-digit number, a debt-to-income ratio is a number, an interest rate is a number, on and on and on. The CEO of the branch must know their business, they must know the numbers. A financial snapshot from the month end financials or from the NCUA’s quarterly report are very good tools to draw the data from. You don’t need to go to deep with the data in the beginning. Start with the fundamentals of the business and build on over time. Here is an example of a credit union financial snapshot.

It is best if this data can be side by side with the respective branch numbers so the manager can see how their branch performance is compared to total performance. Too many times managers only focus on the numbers that make up their goals. A CEO needs to know and understand the whole picture to run a successful business—so do the CEOs of your branches.