Managing a portfolio of loan participations is no different than managing your own loan book: attention must be paid to ever-changing credit risk, interest-rate risk, and one’s liquidity profile, among other things.

Yet, loan participations offer some additional complexities. Loans purchased as part of a participation program are almost always different in kind from the loans originated by the purchasing credit union. The participated loans can feature coupons, credit profiles, collateral types, and geographies far removed from the purchasing institution’s normal business. By purchasing small fractions of loans, credit unions can easily diversify their portfolio across tens of thousands of such loans, even if the credit union has modest liquidity or overall balance sheet capacity.

Loan participations offer tremendous opportunities for diversification, but the purchasing credit unions must skillfully manage and track their participation activities. In this regard, portfolio analytics play a crucial role. The great diversity of loans available through participations can lead to unexpected concentrations, which need to be monitored. The attributes of a portfolio can also change significantly over time, either through “migration” or as the result of additional purchases.

Despite this need, many credit unions continue to operate their participation programs in a manner that reflects historical technology limitations. Historically, many credit unions have only been able to monitor an individual participation’s performance and compare it against their original expectations. This is changing, however, as more and more credit unions deploy modern analytics as a way of actively monitoring their portfolio and ensuring that their diversification objectives are met even as their loan (and participation) portfolio matures over time.

In what follows, we offer several “real-life” examples of participation portfolios and the profound changes they have experienced over time. We use them to demonstrate how appropriate modern analytics can reveal surprising changes in an existing portfolio and provide a roadmap for future action.

Identifying Concentrations

When your portfolio includes loans originated outside your own institution, the potential for diversification increases, but the number of areas where concentrations can build up also increases. In an overall loan portfolio that includes participations, concentrations can build up around certain geographical locations, originators, or loan products. This is of course in addition to more traditional kinds of concentration – around certain vintages, credit-score bands, or collateral types, for example – which also must be vigilantly monitored.

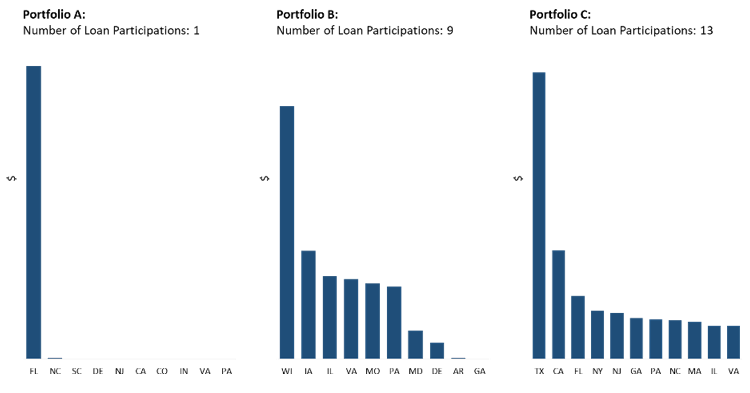

Below are three bar plots, representing the relative distribution by U.S. state of loans in three representative loan portfolios. Portfolio A, covering a single transaction, is almost entirely concentrated in Florida. Portfolio B, covering nine (9) transactions, is concentrated in Wisconsin, but also shows significant investment elsewhere in the Midwest and mid-Atlantic. The broadest, Portfolio C, covering thirteen (13) transactions, is even more diversified, displaying a long tail spread across most of the country. In this regard, the three portfolios are consistent with the theory that additional participation transactions naturally tend to produce greater diversification (absent some strategic investment plan to the contrary).

Of course, the portfolio depicted on the far left is not problematic per se, but identifying and tracking such a build-up in Florida is the duty of a responsible portfolio manager. This type of visibility, which previously was difficult to achieve on an ongoing basis, is now more accessible thanks to modern analytics tools.

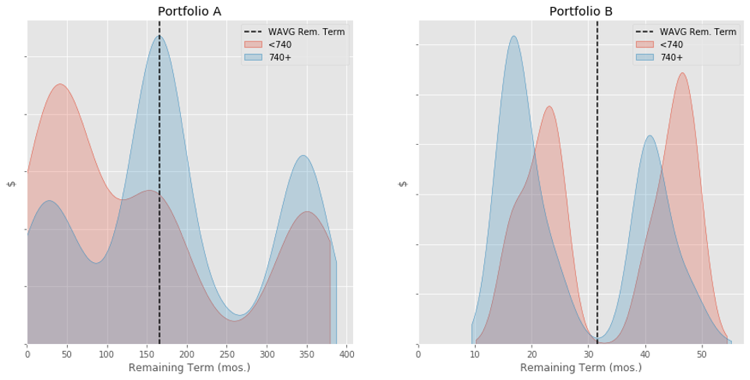

Concentration can also be measured in terms of the remaining term of the loans in a portfolio: an institution’s exposure to a loan’s risk profile increases with the length of the loan, just as it does with the loan’s size. Here, we show the exposure of two different portfolios to credit risk. The curves represent the distribution of loans across the range of remaining terms. In each graph, the blue curve represents lower-credit score borrowers, the orange curve, higher.

Thanks to these visualizations, two things are immediately apparent. First, Portfolio A reflects a far longer position in general: the weighted-average remaining term for Portfolio A is 166 months, compared to 32 months for Portfolio B. Second, Portfolio A is longer in 740+ credit-score loans relative to < 740 loans; Portfolio B is the opposite. Again, neither portfolio is necessarily “better,” but continuously monitoring this type of information and having the tools to visualize it in a useful manner empower better decision making by portfolio managers. A full suite of analytics tools should be able to display how important quantities such as remaining term intersect with other such quantities—credit score, LTV, DTI, etc.—and to show how they change over time. Tracking Changes in Portfolio Attributes Over Time

The overall investment profile of a participation portfolio is almost always changing, either because the underlying participations are changing—through the non-uniform amortization or default of loans—or because additional participations are being added to the portfolio. When these two kinds of changes combine and reinforce one another, changes in the portfolio’s overall investment profile can be material.

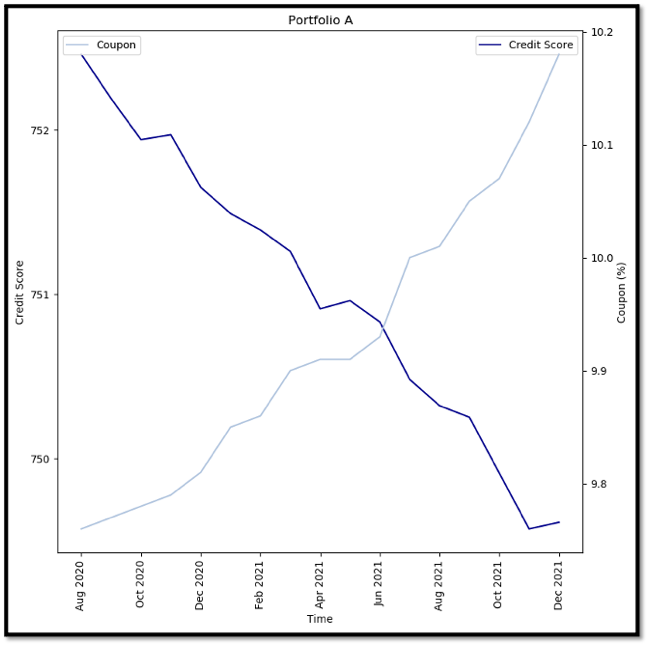

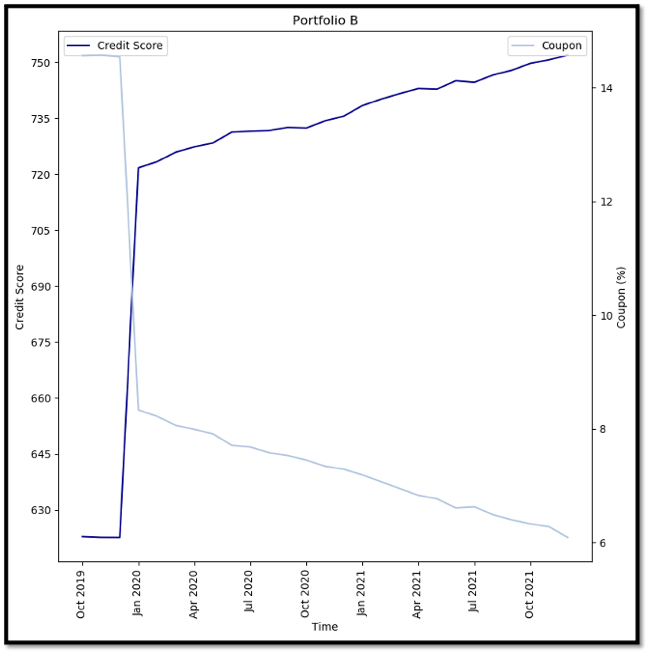

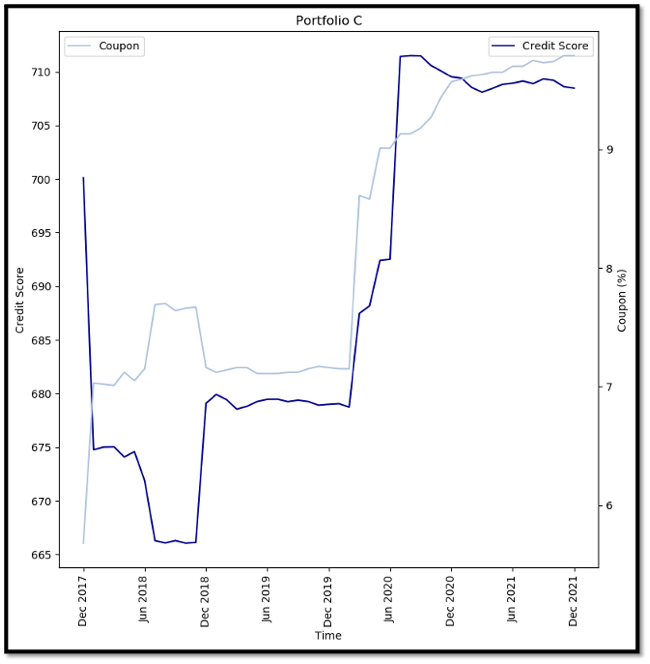

Below are dual-axis graphs for three participation portfolios. The dark-blue line and left axis measure the weighted-average credit score for the portfolio; the light-blue line and right axis, the weighted-average net coupon.

In each of the portfolios, we see migration over time, but with different ultimate effects on the investment profile. Portfolio A has become slightly riskier: the weighted-average credit score has decreased by 3 points, while the coupon has increased by more than 40 basis points. This is the type of small, yet growing, change a portfolio manager should be aware of and think about fine-tuning when deciding upon their next participation transaction.

By contrast, Portfolio B has seen a dramatic de-risking, with the weighted-average credit score increasing by more than 100 points while the coupon has decreased by roughly 8 points. It is unlikely that this change would surprise the owner of this portfolio: it is consistent with an institution consciously choosing to curtail its exposure to riskier borrowers.

Again, neither portfolio A nor B, nor the changes therein, are necessarily good or bad. What is most important is that the portfolio manager can see and understand these trends. With this information in their possession, portfolio managers can evaluate the effects of their previous decisions, make more informed decisions going forward, and brief their management and board more effectively.

Finally, through a series of participation purchases spanning four years, Portfolio C has managed to increase its average credit score while simultaneously increasing its average coupon.

Conclusion

Diversification often entails a larger set of attributes and variables to monitor and keep track of; diversification can also significantly alter the overall investment profile of your portfolio. A robust set of analytics tools makes it easy to monitor and track these and other consequences of diversification.

Ultimately, tracking these attributes over time enables a credit union to make future purchase and sale decisions that reflect the current needs of the balance sheet—not outdated assumptions from the time of purchase or loan origination. Historically, such tracking was difficult, if it was even possible. Today, modern tools enable credit unions to perform these tasks with ease. For the prudent manager of a participation portfolio, these modern tools are indispensable.

Co-authors: Douglas Callahan and Michael Lanzarone