A new report from Elan Credit Card and PYMNTS Intelligence surveyed U.S. consumers about their usage and views of general-use, co-branded, and store credit cards. Of those surveyed, roughly 2.5 times more consumers hold general-use credit cards than co-branded credit cards or store cards, with substantially wider gaps among lower-income consumers and those in younger age groups.

When cardholders were asked what reasoning goes into determining the type of credit card they prefer, “trust in the financial institution that issued the card” ranked as a top reason for general-purpose cards. Why does this matter for credit unions? This is an opportunity to meet cardmember needs and build deeper relationships with existing members by offering the card types that work best for them.

Results show 68% of respondents hold a general-use credit card, with key age cohorts like Gen Z, millennials, and bridge millennials favoring general-purpose cards. This data indicates how critical it is for credit unions to offer this product to members across generations and the credit score spectrum.

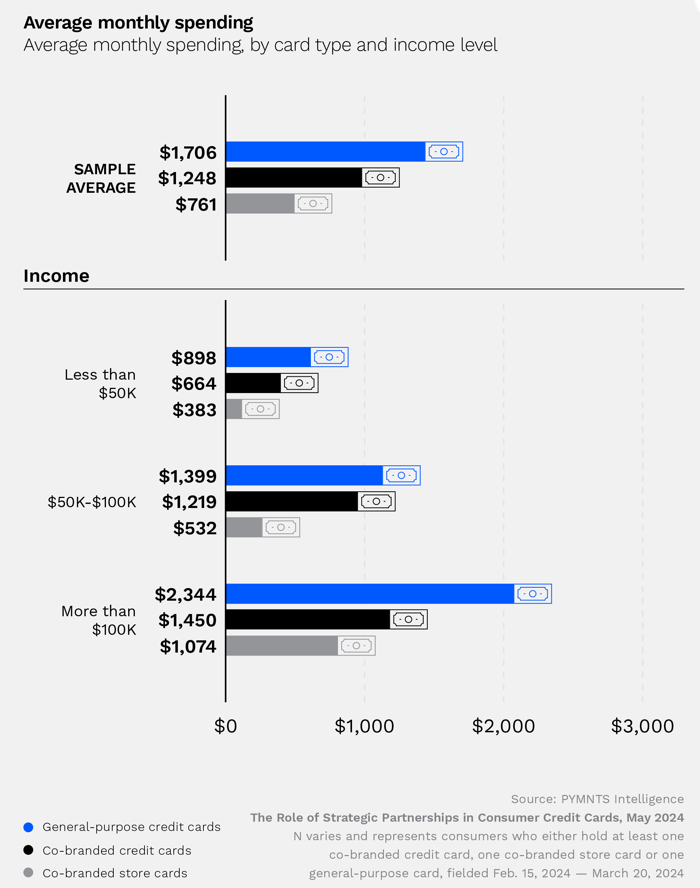

Furthermore, general purpose credit cards see much higher average spending, particularly among consumers with higher incomes. Across the sample, consumers with general-purpose cards spent $1,706 per month, compared to $1,248 on co-branded credit cards and $761 on store cards.

The gaps widen considerably for consumers earning more than $100,000. These consumers monthly spend, on average, $2,344 on general-use cards, $1,450 on co-branded credit cards and $1,074 on store cards.

The data also found that consumers are more likely to pay the full balance on co-branded cards than on general purpose credit cards: 55% of respondents with co-branded store cards and 52% of those with co-branded credit cards pay their full balances off monthly, compared to 49% for general-purpose card holders.

This data underscores the different roles and cardholder habits between each type of card tends to play, with general-use cards treated more as borrowing tools and co-branded cards more as ways to access rewards and loyalty perks. As credit unions work to engage and attract members, it’s important to understand these distinctions.

Download the full report for more insights and trends by demographic, spending habits by card type, and much more.