Capitalize on declining mortgage interest rates…

... and be prepared for when things slow down.

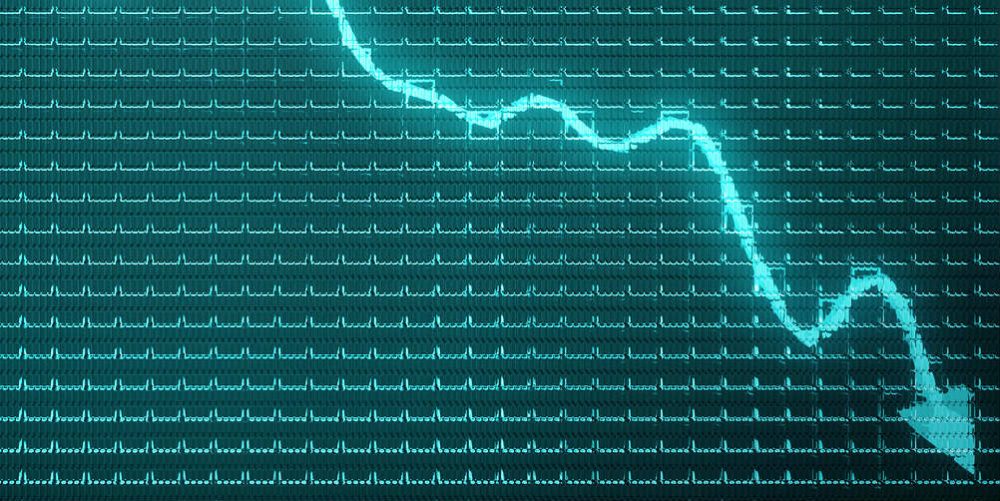

The housing market is a fickle beast. It ebbs and flows, impacted by a number of economic factors, often leaving consumers and lenders alike absorbing copious amounts of information to try to best understand where it’s headed.

In early 2019, the market began to show symptoms of softening, something we had not seen since home prices began to rise again in 2012. However, by late August, the S&P Dow Jones Indices released June 2019 data showing home price increases on a downward decline. So very fickle.

One thing that experts agree on is that the current favorable interest rates and low housing inventory support refinance activity. According to Black Knight, 11.7 million U.S. mortgages have become eligible for a refinance simply due to the current low mortgage rates. As of the first week of September, Freddie Mac released news that the average rate for a 30-year fixed rate mortgage in the U.S. fell to an astonishing three-year low of 3.49%.

continue reading »