When assessing if your financial institution is receiving the best interchange revenue, make sure you consider net interchange. Net interchange is determined by taking the gross interchange assessed, minus the issuer switch fees charged by the network, giving you the net interchange earned.

For example, let’s use an interchange rate of $0.15, plus 1.05% of a purchase amount. On a $50 ticket, that amounts to $0.675 gross interchange income for the transaction. Then, you need to subtract the network issuer fee, which in this case is $0.06, resulting in a net interchange of $0.615.

SHAZAM, like the other networks, has several interchange rates that are unique to specific merchant categories like: general retail, grocery, petroleum, quick service restaurants, e-commerce and bill pay.

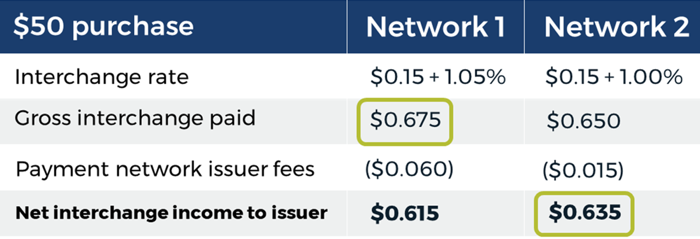

An interchange rate may be a fixed and variable rate, as this example shows, or it could be fixed-rate only, variable-rate only, and in some instances it could also include a cap rate. A cap rate means the merchant can only pay up to that amount in interchange. Now, let’s dig more into net interchange. In the illustration below the fixed fee is $0.15 for both networks and the variable rate is 1.05% for network 1 and 1.00% for network 2. While a 0.05% higher variable interchange amount might not seem like much, when you apply 0.05% to a $50 transaction, it results in network 1 having a gross interchange $0.025 higher than network 2.

The next thing to consider when determining net interchange is the network’s issuer fees. Network 1 has an issuer fee of $0.06, while Network 2 has an issuer fee of $0.015. Once these fees are taken into consideration, as a financial institution, you would want the transaction to route on network 2, as that network provides you with greater net interchange. SHAZAM only charges a network fee when an issuer utilizes our services for both processing and network.

When considering which networks to partner with, gross interchange should not be your only deciding factor. SHAZAM wants to ensure your institution receives the best net interchange on transactions, along with the lowest issuer fees.

Card issuers may achieve greater net interchange revenue when transactions are routed to the SHAZAM debit network. Contact SHAZAM today to do a competitive analysis.