Today’s payment landscape is technologically savvy in a way that no generation has seen before. As quickly as technology advances, so do the expectations of members for an instantaneous, protected, and intuitive payment experience from start to finish.

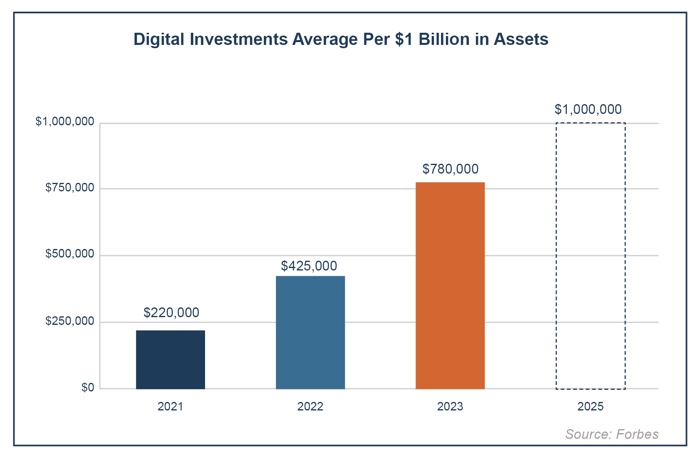

Meeting those expectations brings growing investment. For the second year in a row, financial institutions have doubled their investment in technology. Per each $1 billion in assets, the 2023 average was a $780,000 investment in technology and if the trend continues by 2025, that number will exceed $1 million per $1 billion in assets.

Why do financial institutions feel compelled to make this significant and growing investment? Roughly 40% of users say a poor digital experience reduced how often they bank at a financial institution. This reduction in interaction frequency, reduces a financial institution’s ability to deepen the member relationship. In addition to friction-free usability for members, technology enhancements don’t stop with digital user-facing environments.

So what solutions are leaders investing in? What technology is on the rise?

One of the biggest overhauls recently in banking is the move to cloud platforms and shared API-based services. More than 90% of banks surveyed said they maintain at least some data, applications, or operations in the cloud. These systems create the foundation for both internal and external functionality, communication, and data sharing.

Replacing legacy core systems with cloud provides secure delivery and storage of cardmember data, allows for personalized and instantaneous information sharing, and broad scalability of programs and continuity.

As credit unions continue to grow their API adoption, they will be able to provide an improved member experience, as well as a more technologically competitive interface.

Artificial intelligence (AI) is also gaining wider acceptance. We found that more than 50% of leaders are investing in AI. Almost four in ten (39%) finance leaders say they’re not confident about their current ability to manage and mitigate risks given fluctuating economic experience and these finance leaders hope that help will arrive with AI advancements. AI can help finance teams mitigate risks and reduce expenses by, for example, flagging potential instances of fraud by recognizing unusual transaction size and frequency, payee changes, or multiple transactions being executed from the same device.

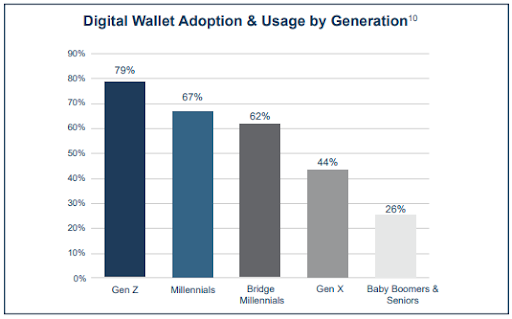

Members, especially younger generations, want features available like BNPL (buy now, pay later), digital wallets, instant line access, deeper transaction data and more. The BNPL function started with firms such as Klarna or Affirm, which offered the payment option at checkout with certain businesses that then would let users manage their purchases and payments in a separate app. Now, the same technology is available to many cardmembers via their credit card, though usually managed post-purchase.

Despite no longer being the newest technology on the block, BNPL is still growing in interest with consumers. Financial industry forecasting predicts that in the U.S. alone, BNPL transaction value will rise from $80.8 billion in 2024 to $124.8 billion in 2027. BNPL financing allow consumers to split payments for an individual purchase into monthly or extended payments.

Digital wallets are another payment solution gaining traction. Digital wallets are a streamlined, secure, and user-friendly payment method available via a connected device. When making a purchase, users can access their payment method digitally to make an instantaneous purchase. A recent study estimates that digital wallets will account for 61% of ecommerce payments and 46% of point-of-sale payments worldwide by 2027 signaling a shift in payment preferences.

As credit unions continue to adjust their strategy to attract and retain millennials and Gen Z members, offering functionality like digital wallet solutions is vital.

It’s understandable that credit union leaders may feel overwhelmed by rapidly advancing technology, fraud risk, and competition. Exploring a third-party partnership can alleviate risks and costs for smaller financial institutions while delivering the technology members expect.

Strategic partnerships can help support credit unions in many ways. A partner brings the expertise, scale, and ability to bring products, solutions, and the latest technology to members quickly—and at no cost to the institution. There can be hesitation from leaders about choosing to outsource, but the right partner can be a seamless extension of the credit union.

Download this whitepaper to learn about more trends in payments technology and what solutions Elan can offer to your members.