No matter how sophisticated your credit union’s technology may appear, it’s notIFa cyberattack will occur, butWHEN. How your credit union responds before, during and after a cyber incident will likely impact public perception and either strengthen or weaken trust with your members, prospective members and the communities you serve.

In a recent study conducted byReputationUs(RepUs) andDHM ResearchduringCybersecurity Awareness Month(every October), the firms examined the effects of cyberattacks on corporate reputation and consumer confidence. Complete details about the survey, including an analysis of the findings and a list of key insights are availablehere.

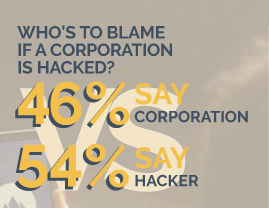

CREDIT UNION OR HACKER … WHO’S TO BLAME FOR A CYBERATTACK?

One of the most telling results of the study is consumers almost equally blame the company (46 percent) than the hacker (54 percent) when an attack occurs. After an attack happens, there is plenty of “cyber blame” to go around. The blame and reputational damage usually fall on the shoulders of the company … not the bad actors.

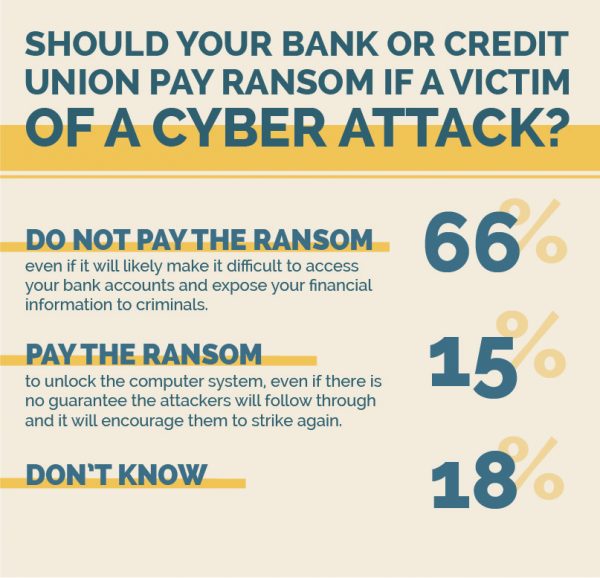

SHOULD CREDIT UNIONS PAY RANSOM IF ATTACKED?

The RepUs and DHM study also unveiled public sentiment about if a financial institution should pay ransom if it became victim to a cyber attack. Two-thirds (66 percent) of the respondents claimed the bank or credit union should NOT pay the ransom, while 15 percent asserted the financial institution should pay the ransom, and 18 percent did not know.

DECREASE IN MARKET VALUE

In a related report, the Aon and Pentland Analytics’ studied reputation risk in today’s cyber age. The report underscored the impact of a cyberattack on shareholder value, showing a25 percent decrease intheir market value over the year following an attack.

STEPS TO MITIGATE DAMAGE

In our experience, we promptly learned that credit unions are not fully prepared to address the potential reputational damage a cyberattack has on the organization. To mitigate against this damage, RepUs created a cyber response procedure to include a:

- Reputation Assessmentto identify vulnerabilities in how credit union’s respond before, during and after a cyberattack.

- Reputation Protection Planto address, with step-by-step actions, how to address vulnerabilities and safeguard reputations before, during and after a cyber incident.

- Urgent supportif/when a cyberattack happens to mitigate against reputational damage.

Is your credit union willing to risk its reputation on today’s all-too common cyberattack? It’s time to proactively strategize your approach to cybersecurity by playing offense—not defense—to minimize the damage of the credit unions operations and overall reputation.