If you’re currently living paycheck to paycheck, when payday hits you think you have all the money in the world. But then, after bills are paid and groceries are bought, there is very little money for anything extra. Keep in mind though, that even though it may seem stressful, if you follow these tips and save, you can make it work!

Trim the fat

Take a closer look at things you pay for that you don’t actually NEED. For example, I had over 200 television channels in addition to Netflix. When I stopped to really think about it I realized that both my son and I prefer programs offered by the streaming service. So, why would I pay for an abundance of channels I do not actually ever watch? I decided to cut my package down to the bare minimum; keeping only the basic channels lowered my monthly bill by close to $100.

Cut those coupons

Unfortunately going grocery shopping is not what it used to be. It is next to impossible to leave the store without spending at least $100. Therefore, it is important you do everything you can to cut food costs. One way to do this is to use every coupon you can. You don’t have to be an extreme coupon-cutter to take advantage of the savings because every little bit helps. Think about it- if you find a coupon for 75 cents off a bar of soap and you don’t use it, isn’t that like throwing money away?

Come up with a game plan

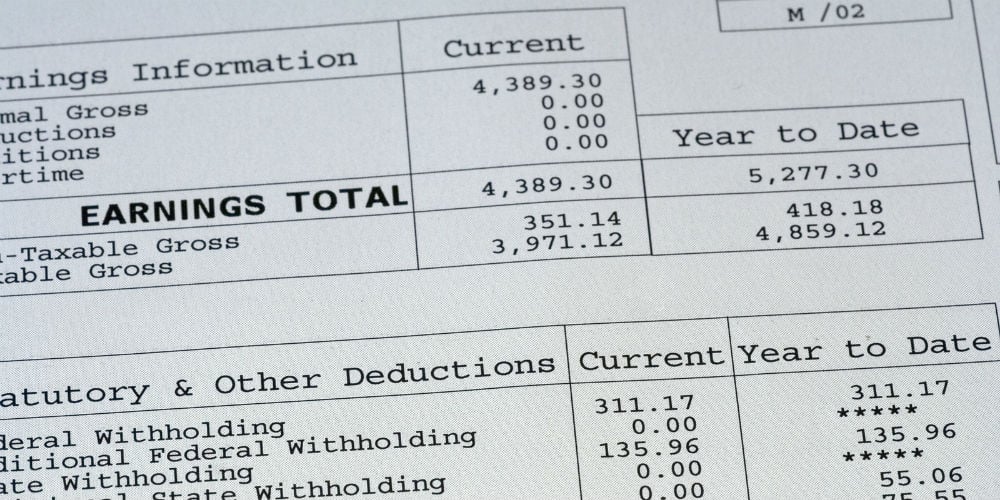

When you get paid, do you sit down and make an actual budget? This is something I struggle with but when you actually do it, it does make a difference. Give yourself an allowance for the “extras,” even if it’s $15-$20. It takes will power, but it’s important to not get ahead of yourself if you’re short on cash. The feeling of having less of a financial burden and therefore less stress will be worth it in the end, even if you have to pass on the occasional happy-hour.